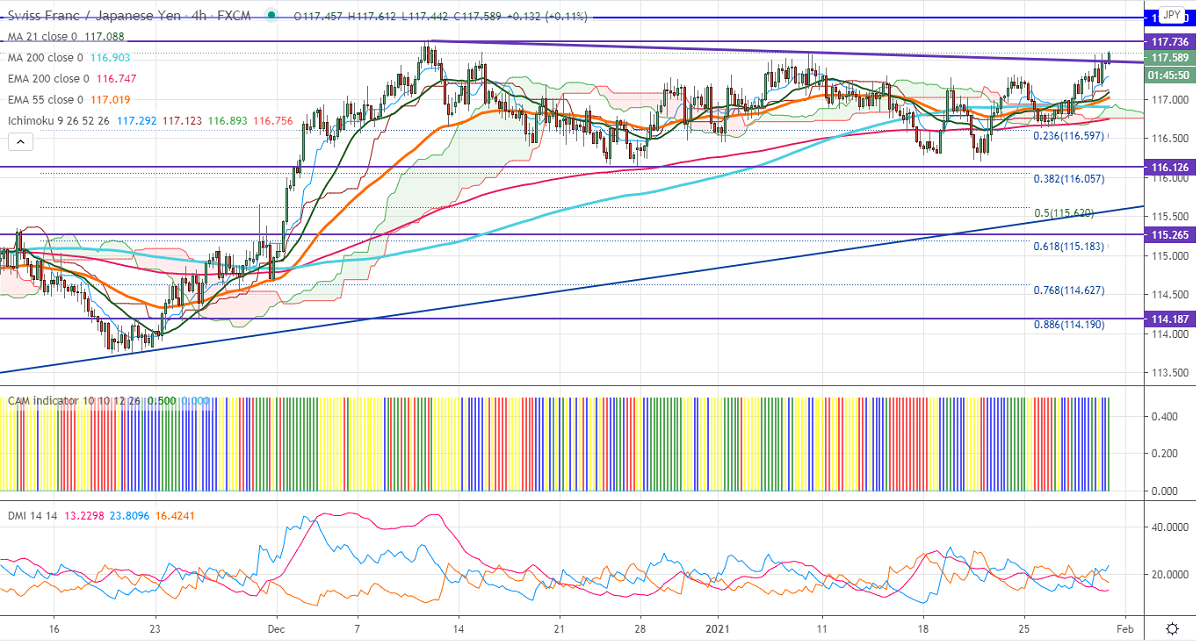

Ichimoku analysis (4-Hour chart)

Tenken-Sen- 117.27

Kijun-Sen- 117.10

CHF/JPY continues to trade higher after a minor dip till 117.16. The weakness in the yen is supporting the pair at a lower level. USDJPY hits 2- week high and is holding above 104.40. A jump till 105.38 likely. USDCHF is consolidating in a narrow range between 0.89250 and 0.88385 for the past ten days. Any jump above 0.8925 confirms a bullish continuation. The intraday trend of CHFJPY remains bullish as long as supports a 117 hold.

Technical:

The pair's strong resistance is at 117.76, violation above will take to the next level 118.05/118.60. On the lower side, near term support is around 117, and any indicative break below targets 116.60/116/115.84.

Indicator (4-hour chart)

CAM indicator –Neutral

Directional movement index – Neutral

It is good to buy on dips around 116.60 with SL around 116.20 for the TP of 118.60.