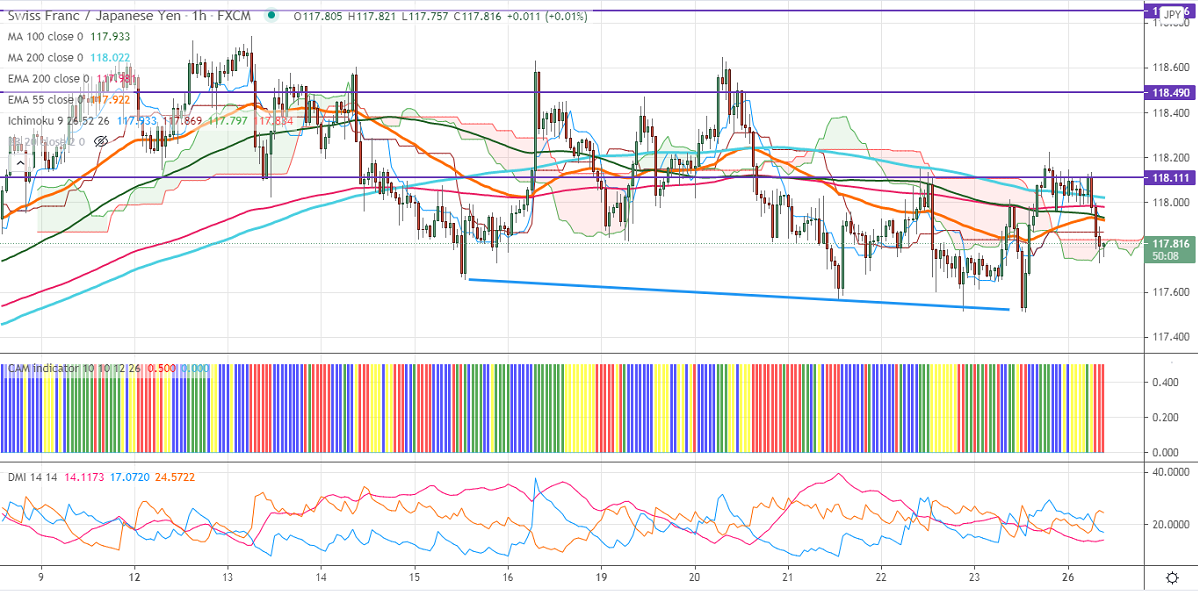

Ichimoku analysis (4-Hour chart)

Tenken-Sen- 117.69

Kijun-Sen- 117.83

CHF/JPY has taken support near 200-4H MA and shown a minor recovery till 118.22. The overall trend of this pair is still neutral as long as 118.75 holds. The long-term chart shows that the pair is holding above 100 and 200- day MA. The broad-based strength in the Japanese yen due to easing US bond yield and increase in demand for safe-haven assets. USDJPY is holding well below 108 and a dip till 107.20 is possible. USDCHF continues to trade lower, a minor pullback is possible till 0.9185 due to bullish divergence RSI (4-hour chart).

Intraday analysis-

Trend – bearish

The pair is struggling to close above 200-H MA 118.02. this confirms intraday weakness, a dip to 117.50 is possible. Any break below 117.35 confirms minor weakness, and a dip till 116.90/116.09 likely. On the higher side, near-term resistance is around 118.02, and any indicative break above targets 118.25/118.75.

Ichimoku Analysis- The pair is trading below hourly Kijun-Sen, Tenken-Sen, cloud, and 200-MA.

Indicator (1-Hour chart)

CAM indicator – Bearish

Directional movement index – Bearish

It is good to sell on rallies around 118 with SL around 118.60 for a TP of 116.20.