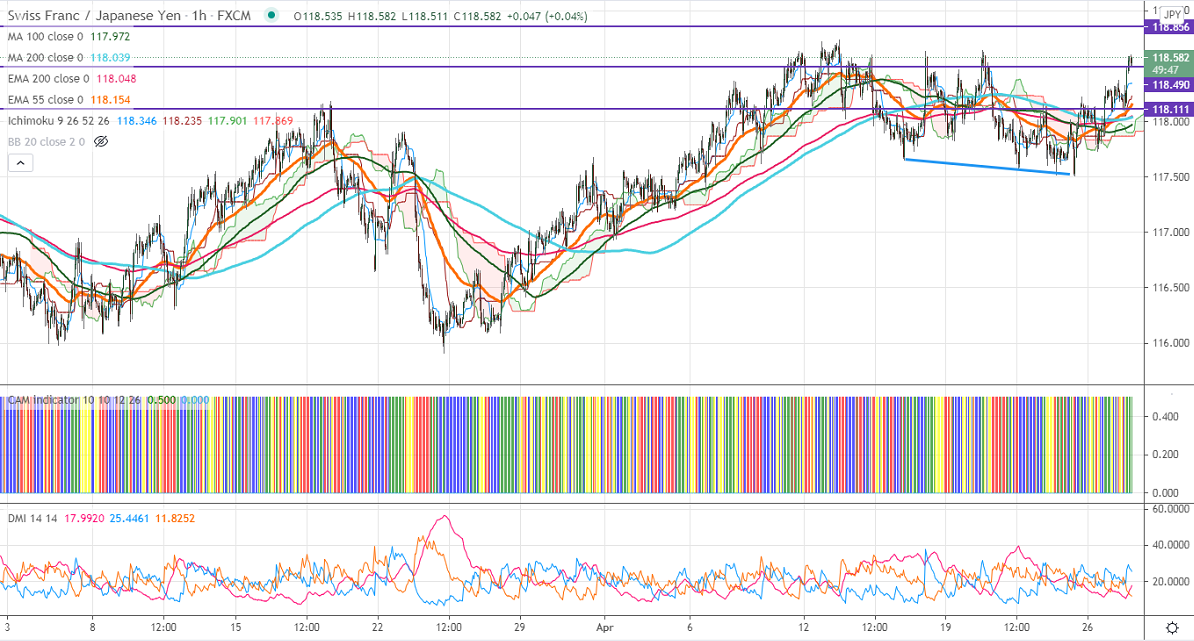

Ichimoku analysis (Daily chart)

Tenken-Sen- 118.48

Kijun-Sen- 118.38

CHF/JPY continues to trade higher for third consecutive days on broad-based Swiss franc buying. USDCHF is trading weak after a minor pullback till 0.91800. Any violation below 0.9120 confirms bearish continuation. The overall trend of this pair is slightly bearish as long as support 117.60 holds. The long-term chart shows that the pair is holding above 100 and 200- day MA. The minor weakness in Japanese after BOJ kept its policy unchanged. Any jump above 108.50 targets 109.

Intraday analysis-

Trend – Bullish

The pair is holding well above 200-H MA 118.03. The pair should break above 118.75 for further bullish continuation. A jump till 119/119.60 likely. On the lower side, near-term support is around 118. Any break below targets 117.60/117.20.

Ichimoku Analysis- The pair is trading above hourly Kijun-Sen, Tenken-Sen, cloud, and 200-MA.

Indicator (1-Hour chart)

CAM indicator – Bullish

Directional movement index – Bullish

It is good to buy on dips around 118-78-80 with SL around 118.40 for a TP of 119.60.