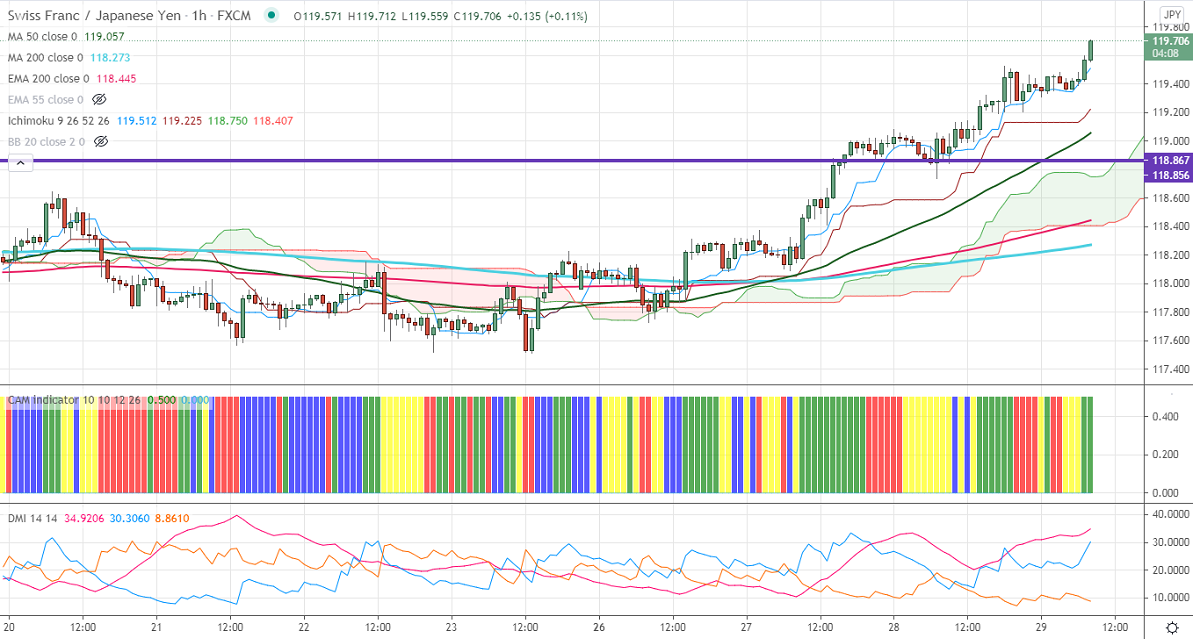

Ichimoku analysis (Hourly chart)

Tenken-Sen- 119.45

Kijun-Sen- 119.16

As per our analysis, CHF/JPY jumped sharply after breaking significant resistance 118.85. It has jumped to 119.68 and is currently trading around 119.64. USDCHF breaks strong support 0.9120 after a long consolidation and hits a multi-week low on broad-based US dollar selling. The yen also trading weak on the surge in US bond yield. USDJPY is facing major resistance at 109.25. Any breach above that level confirms intraday bullishness. The intraday trend of this pair is bullish as long as support 118.25 holds. The long-term chart shows that the pair is holding above 100 and 200- day MA.

Intraday analysis-

Trend – Bullish

The pair is holding well above major resistance 118.85. The pair should break above 120 for further bullish continuation. A jump till 122/123 likely. On the lower side, near-term support is around 119.20 Any break below targets 118.80/118.25.

Ichimoku Analysis- The pair is trading well above hourly Kijun-Sen, Tenken-Sen, cloud, and 200-MA.

Indicator (Hourly chart)

CAM indicator – Bullish

Directional movement index – Bullish

It is good to buy on dips around 119.25-30 with SL around 118.80 for a TP of 121.