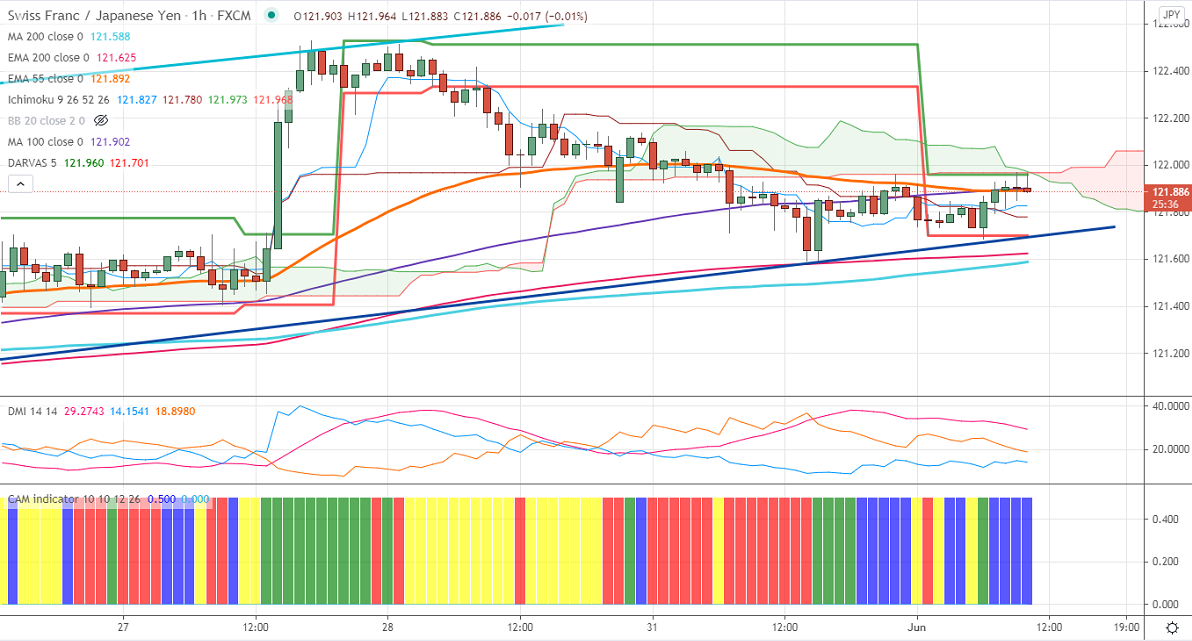

Ichimoku analysis (1 Hour chart)

Tenken-Sen- 121.82

Kijun-Sen- 121.78

CHF/JPY is trading flat after a minor sell-=off till 121.59. The slight bearish trend in the Swiss franc is putting pressure on this pair at higher levels. The pair was one of the best performers in the past two months and surged more than 500 pips on board–based Swiss franc buying. USDCHF has formed temporary bottom around 0.89303 and shown a minor pullback, It should close above 0.9045 for a further bullish trend. USDJPY is holding well above 200-WMA, any breach above 110.20 targets 111. The intraday trend of CHFJPY is bullish as long as support 121.45 holds.

Intraday analysis-

Trend – neutral

The pair is holding above Hourly Tenken-Sen, above Kijun-Sen, and cloud. On the lower side, near-term support is around 121.50 Any violation below will drag the pair down to 121/120.50/120/119.25/118.60/117.95/116 likely. The immediate resistance is only 122.55. Any violation above that level will take the pair to next level to 123/123.93/124.45.

Indicator (1-hour chart)

CAM indicator –Bearish

Directional movement index – Slightly Bullish

It is good to sell on rallies around 122 with SL around 122.50 for a TP of 120.