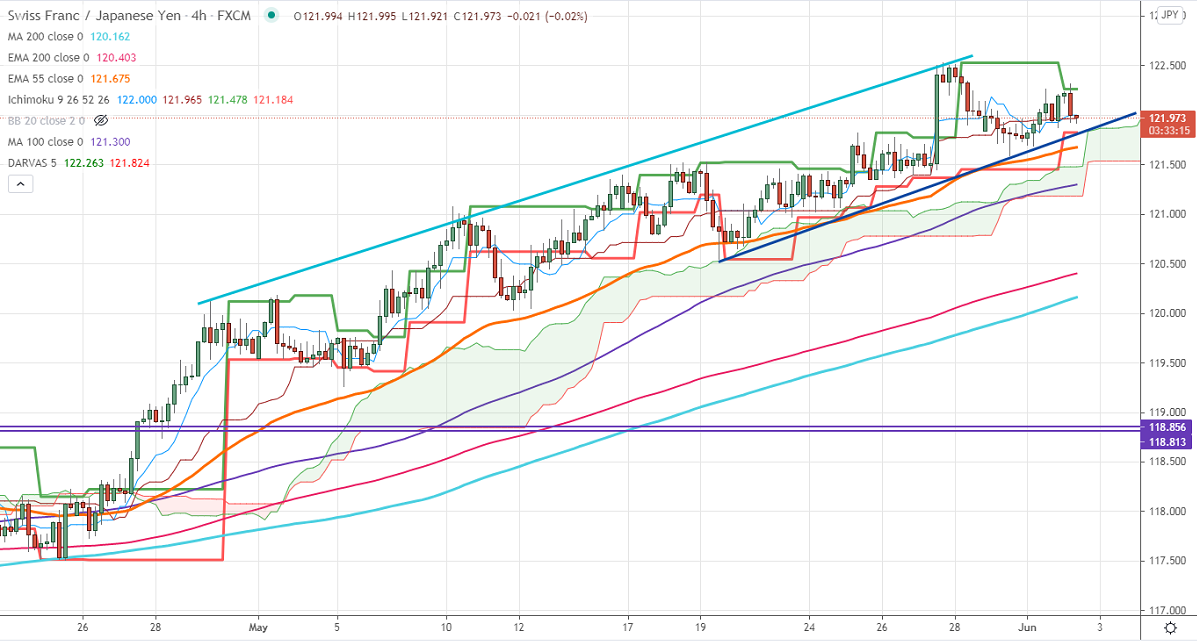

Ichimoku analysis (4 Hour chart)

Tenken-Sen- 122

Kijun-Sen- 121.96

CHF/JPY has once again declined after a minor jump above 122 level. The Swiss franc has halted its bullish trend against the USD after a major sell-off. Any surge pat 0.9030 confirms intraday bullishness. The slight pullback in USDJPY is putting pressure on CHFJPY at higher levels. The pair was one of the best performers this year and jumped more than 500 pips due to the board–based yen selling. USDJPY is holding well above 200-WMA, any breach above 110.20 targets 111. The intraday trend of CHFJPY is bullish as long as support 121.45 holds.

Intraday analysis-

Trend – neutral

The pair is holding below 4-Hourly Tenken-Sen, above Kijun-Sen, and cloud. On the lower side, near-term support is around 121.50 Any violation below will drag the pair down to 121/120.50/120/119.25/118.60/117.95/116 likely. The immediate resistance is only 122.55. Any violation above that level will take the pair to next level to 123/123.93/124.45.

Indicator (4-hour chart)

CAM indicator –Neutral

Directional movement index – Neutral

It is good to sell on rallies around 122 with SL around 122.50 for a TP of 120.