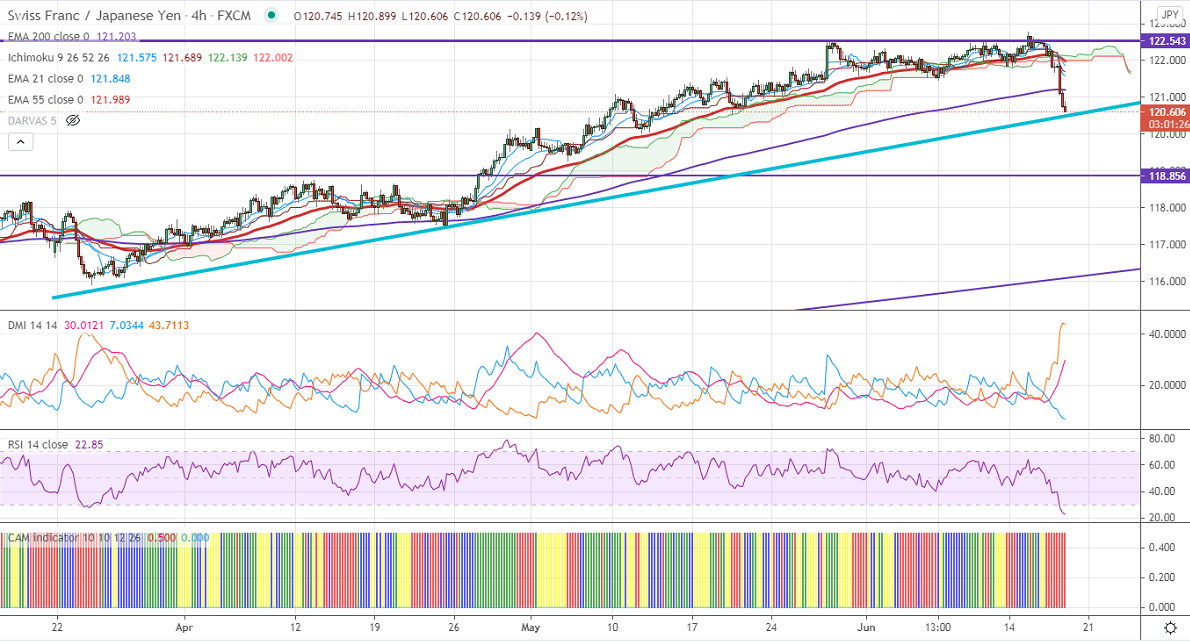

Ichimoku analysis (4 Hour chart)

Tenken-Sen- 121.63

Kijun-Sen- 121.74

CHF/JPY is trading extremely lower and lost more than 100 pips. The board-based sell-off in Swiss franc is putting pressure on this pair. USDCHF surged sharply after the hawkish Fed and hits five weeks high. The pair is holding above 200-day EMA, a jump till 0.9260 is possible. USDJPY has halted its 4 days of the massive rally and lost more than 40 pips. The intraday trend of CHFJPY is bearish as long as resistance 122 holds.

Intraday analysis-

Trend – Bearish

The pair is holding well below 4-hour Tenken-Sen, Kijun-Sen, and cloud. On the lower side, near-term support is around 120.45. Any violation below will drag the pair down to 120/119.03/118 likely. The immediate resistance is only 121.25. Any violation above that level will take the pair to next level to 121.60/122/122.77.

Indicator (4-hour chart)

CAM indicator –bearish

Directional movement index – Bearish

It is good to sell on rallies around 121 with SL around 121.50 for a TP of 118.