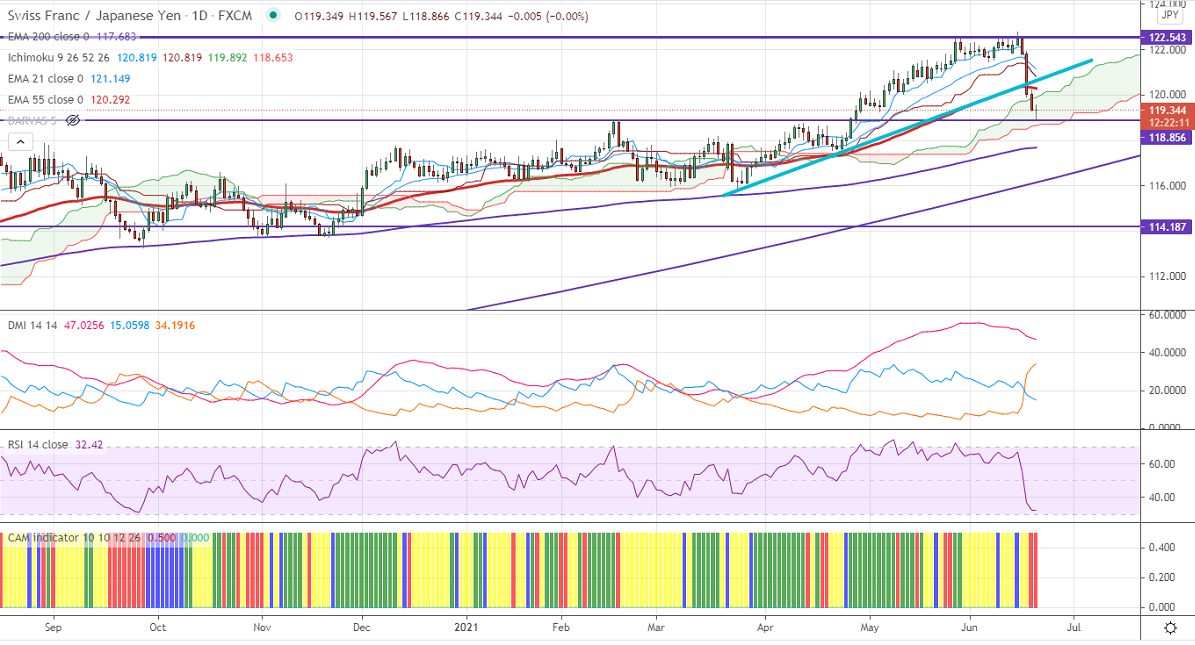

Ichimoku analysis (Daily chart)

Tenken-Sen- 121.02

Kijun-Sen- 121.02

CHF/JPY was one of the worst performers in the previous week and lost more than 300 pips. The board-based Swiss franc selling is putting pressure on this pair at higher levels. USDCHF jumped more than 250 pips from a close of 0.89775. The minor strength in the yen is further dragging CHFJPY down. USDJPY recovered from the day's low of 109.71 and holding above 110 levels despite the safe-haven appeal.

Intraday analysis-

Trend – Bearish

The pair is holding well below trend line support and 200- day EMA for the second consecutive days. This confirms bearish continuation, a dip till 117.75 is possible. The immediate resistance is only 119.80. Any violation above that level will take the pair to next level to 120.30/121/121.60.

Indicator (Daily chart)

CAM indicator –bearish

Directional movement index – Bearish

It is good to sell on rallies around 120 with SL around 121 for a TP of 118.