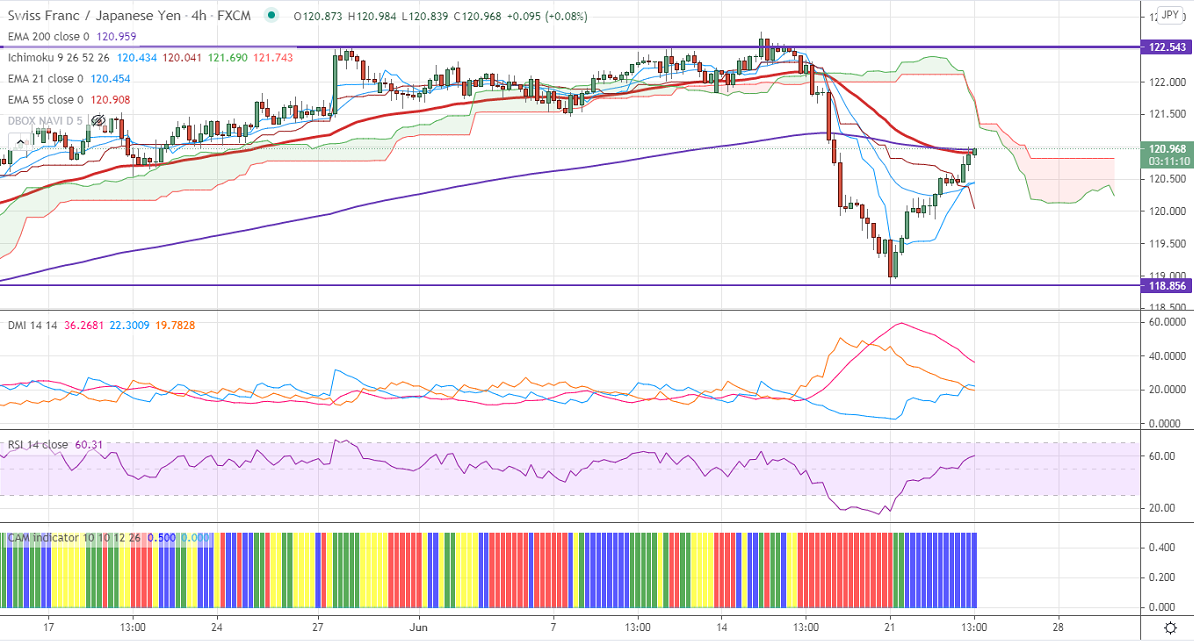

Ichimoku analysis (4-Hour chart)

Tenken-Sen- 120.43

Kijun-Sen- 120.37

CHF/JPY recovered sharply after a major sell-off. The board-based weakness in the yen is supporting the pair at lower levels. The Swiss franc continues to trade lower against all majors. USDCHF has halted its four weeks of the bullish trend and showing a minor profit–booking. USDJPY is holding well above 110 levels, any breach above 111 confirms trend continuation.

Intraday analysis-

Trend – Bullish

The pair is trading well above Tenken-Sen, Kijun-Sen, and cloud. The near-term significant resistance is around 120.95 (200- day EMA). Any close above confirms a bullish continuation. A jump till 121.65/122/122.50 is possible. The immediate support is around 120.40. Any violation below at level will take the pair to next level to 120/119.66.

Indicator (4-Hour chart)

CAM indicator –Slightly bullish

Directional movement index – Neutral

It is good to buy on dips around 120.85-90 with SL around 120.40 for a TP of 122.