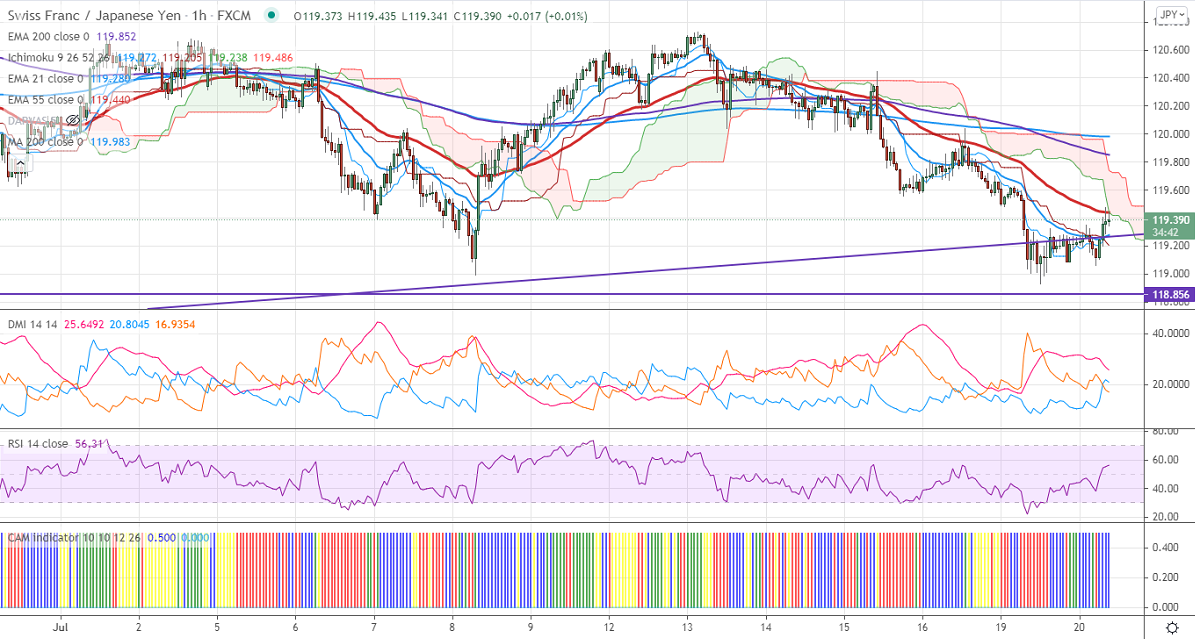

Ichimoku analysis (1-Hour chart)

Tenken-Sen- 119.27

Kijun-Sen- 119.23

CHF/JPY has formed triple bottom around 118.86 and has shown a minor recovery. The spread of delta variant coronavirus cases has increased demand for Safe-haven assets like the Swiss franc. This year, the pair was one of the best performers and surged more than 500 pips on board-based yen weakness. USDJPY trading weak as US treasury yields hits 5-month low.

Intraday analysis-

Trend – neutral

The pair is trading above 1-hour Tenken-Sen, Kijun-Sen. The near-term resistance is around 120 (200-H MA). Any close above targets 121/122/123. The immediate support is around 118.85. Any decline below that level will take the pair to 118.50/118/.

Indicator (1-Hour chart)

CAM indicator –Slightly Bullish

Directional movement index –Neutral

It is good to sell on rallies around 120 with SL around 121 for a TP of 118.