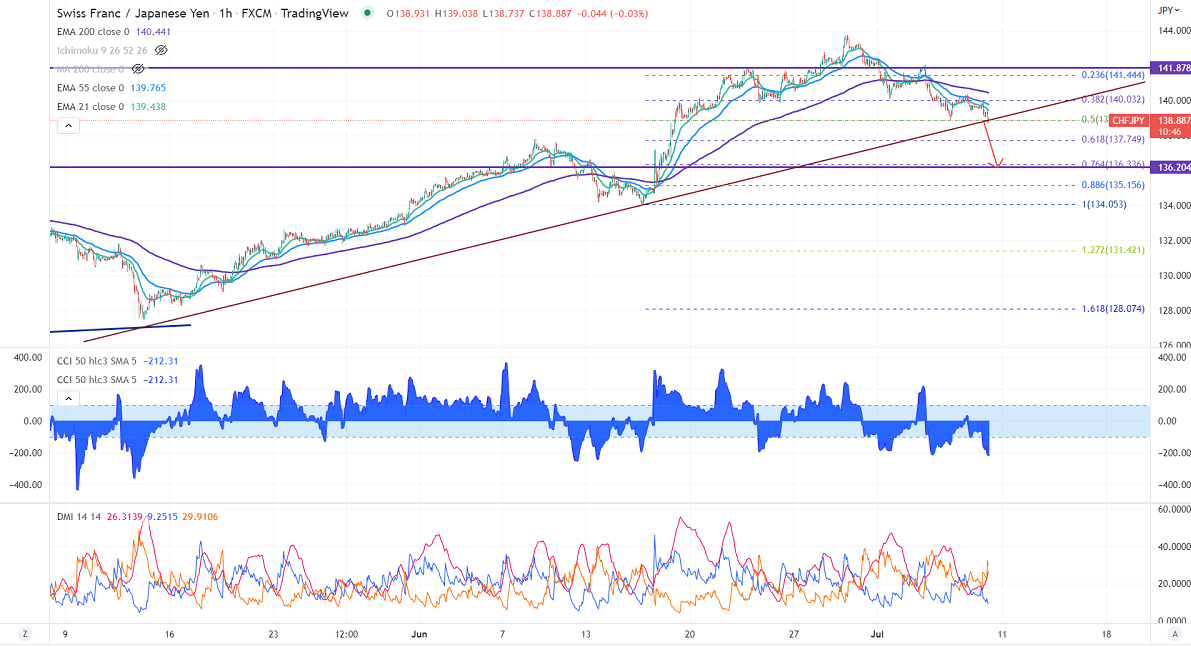

Major Intraday resistance - 140

Intraday support- 138

CHFJPY breaks significant trend line support and holds below that level. The Japanese yen gained strength after shooting Japan's ex-PM. The weakness in the Swiss franc against the US dollar on the board-based US dollar also puts pressure on this pair. Technically, in the 4-hour chart the pair trades below short-term ( 21 and 55 EMA) and above the long-term 200- EMA (138.01) moving average. CHFJPY hits an intraday low of 138.37 and is currently trading around 138.80.

CCI and Directional movement index analysis-

CCI (50) - Bearish

ADX - Bearish

Technically, near-term support is around 138 and any indicative break below will drag the pair down to 137/136. The immediate resistance is at 139.40, and any convincing break targets 140/140.85/141.95.

It is good to sell on rallies around 139.15-20 with SL around 140 for TP of 136.