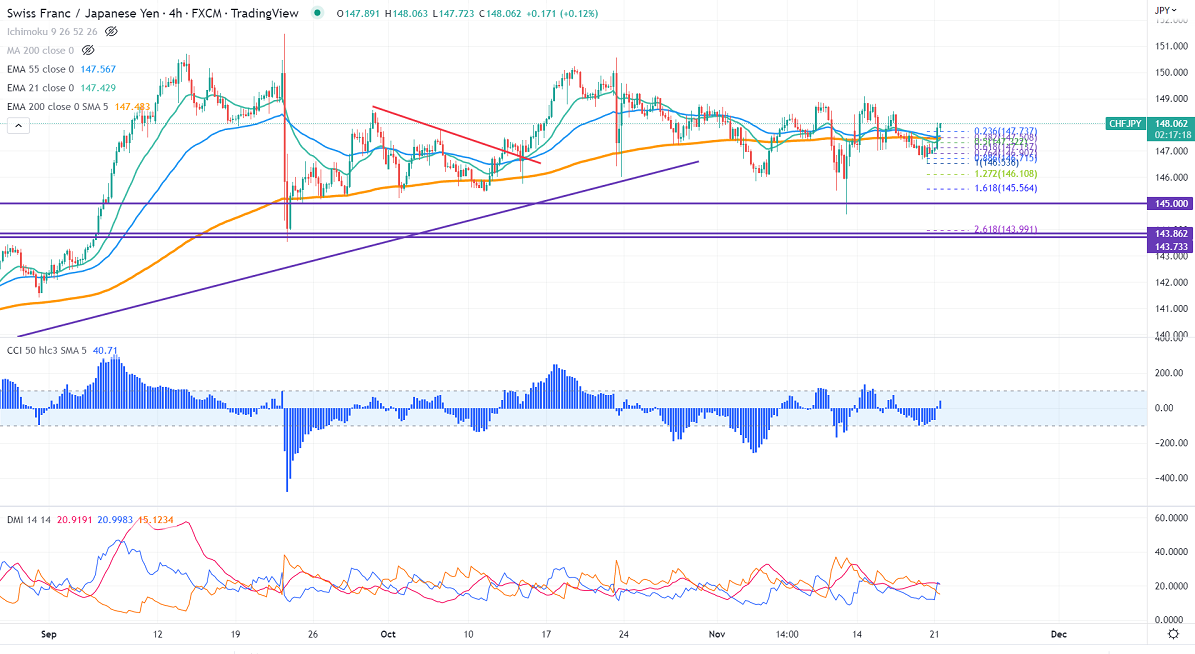

Major Intraday resistance - 148.50

Intraday support- 147.35

CHFJPY recovered more than 100 pips on the weak Yen. It was one of the best performers in the past three months and surged over 1000 pips on the strong Swiss Franc. The escalation of Russia and Ukraine geopolitical tension and diminishing hopes of aggressive rate hikes by the Fed pushed the Swiss franc higher against the US dollar. Technically, in the 4-hour chart the pair trades above the short-term ( 21 EMA), below 55- EMA, and the long-term 200- EMA (147.47). CHFJPY hits an intraday high of 148.08 and is currently trading around 148.

CCI and Directional movement index analysis-

CCI (50) - Bullish

ADX - Bullish

Technically, near-term support is around 147.70, and any indicative break below will drag the pair down to 146.90/146/144.60/. The immediate resistance is at 148.20, and any clear violation above targets 149.10/150.

It is good to buy on dips above 147.70 with SL around 147 for a TP of 149..