Intraday trend – Bullish

Major intraday resistance – 133

The pair performed well compared to others on the strong Swiss franc. It gained sharply after hawkish comments from the SNB chairman and an increase in demand for safe-haven assets. But strong yen prevents the pair from further upside. CHFJPY hits an intraday high of 132.73 and is currently trading around 132.726

Technical analysis-

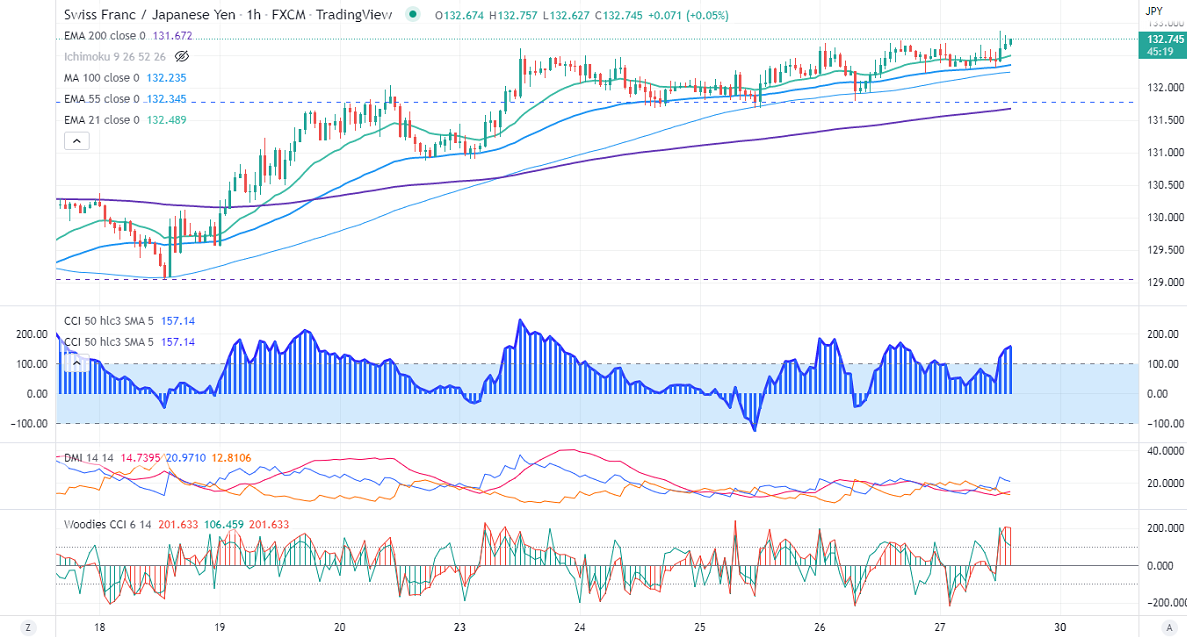

CHFJPY is trading above 200 and 100 4H EMA (131.52 and 131) and confirms a bullish trend.

The near-term resistance is around 133, any breach above targets 135/136.20/137. The minor support to be watched is 131.60; the violation below will drag the pair down to 130.80/130.

Indicators (4-hour chart)

Directional movement index – Neutral

CCI (50) – Bullish

Woodies CCI- Bullish

It is good to buy on dips around 132 with SL around 130.80 for a TP of 135.