Short EURCHF: This trade serves as a portfolio-level hedge against forthcoming European political risk (we have a range of long Europe/short USD bloc trades and so have an implicit long exposure to EURUSD).

But the trade was originally motivated as an outright positive play on CHF, the simple argument being that Switzerland’s underlying balance of payments (BoP) surplus would outstrip the SNB's ability and willingness to grow its balance sheet in pursuit of a stable nominal exchange rate.

We do not expect the SNB to permanently withdraw from the FX market; we nevertheless do expect it to move away from a policy of systematic intervention that could be cited as evidence of de facto currency manipulation and to confine intervention instead to periods of more pronounced FX stress.

The result should be a glacial trend decline in EURCHF, in our view towards the 1.03 level, i.e. a cent a quarter. Low return but also low risk, in our opinion.

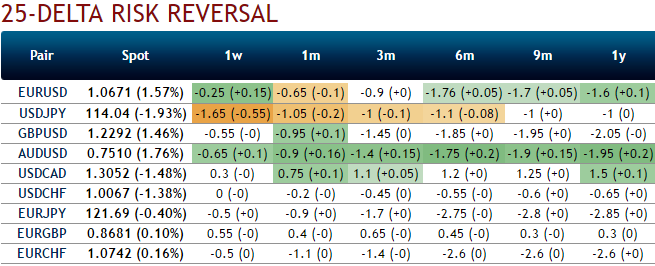

Please be noted that the delta risk reversals of this pair are signaling hedging interests for downside risks, while 1m IV skews also moving in sync with the same indications (please note positively skewed IVs would mean that the hedgers’ interests in OTM put strikes are mounting.

Hence, we advocate staying short in EURCHF via vanilla structures, bidding 3m risk reversal are likely to encompass all potential risks as explained above in conjunction with political risks that is clouded around euro, buy 3m at the money -0.49 delta put options.

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks