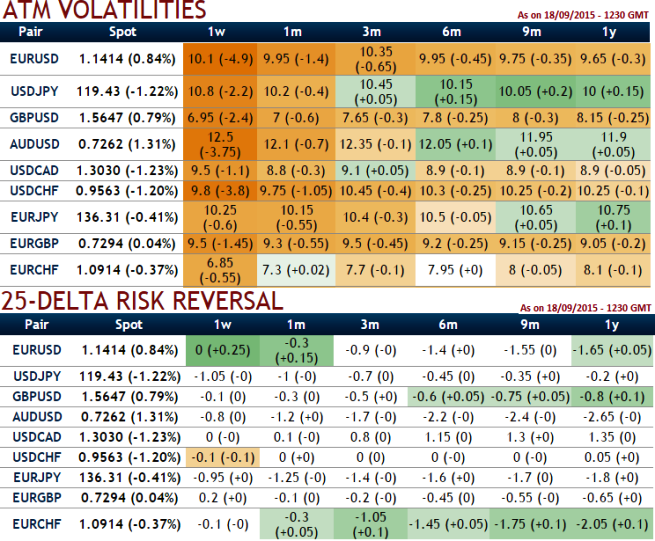

The delta risk reversal of 1W for this pair is still highly negative values, this would mean that negative market sentiments for this pair have been lingering for this pair, on the contrary even if it falls, it would not slip beyond 125.50 in near future and on upside it would not rise also beyond 140.50. Moreover, the pair is likely to perceive implied volatility close to 12-13% of ATM contracts, thus we recommend deploying butterfly spreads which is quite suitable for prevalent range.

On hedging grounds we construct long put butterfly spread on this pair which offers restricted returns and limited risk, this strategy is advisable as we think that EURJPY will not rise or fall beyond above stated levels by expiration.

Why butterfly spread: Use this sideways strategy for capital gain, when you want to accomplish this a low cost and where maximum profits occur when the EURJPY finished at the middle strike at expiration.

So, assured returns must have been enjoyed if the execution went in this way when we advised this strategy on hedging grounds on 15th: Spot FX EURJPY is currently trading at 135.852. Buy 4D out of the money put and 4D in the money put simultaneously short 2D 2 lots of at the money puts for a net debit.

Advantage: The benefit here is that you can realize a capital gain for little cost and capped risk.

Risk/Reward Profile: The risk is the net debit of the sold and bought options. The reward is the difference between adjacent strike prices minus the net debit.

FxWirePro: Certain yields on EUR/JPY butterfly spreads with shorter expiry

Monday, September 21, 2015 6:25 AM UTC

Editor's Picks

- Market Data

Most Popular

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings