There has been a change in tide in the commodities market, which we feel is of utmost importance to keep a tab on.

Historically speaking, a rise in commodity prices has triggered a vicious chain reaction. First, the prices of commodities go up, which in turn triggers a rise in inflation, which again has historically triggered selloffs in bonds, which has not been good for equities sometimes. In a world, where central banks have provided unprecedented stimulus, the rise in inflation is the biggest possible threat.

Last year can easily be called as the year of the commodities. They were the best performing asset class, but will that continue in 2017 too? We are looking for the answer.

The ‘Meat’ pack has been the worst performer of the year in 2016, and in 2017 they are looking relatively brighter.

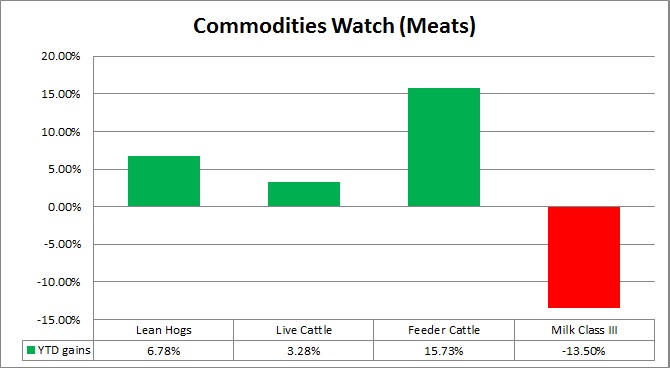

In this article, we evaluate the YTD performance of the meats and products, which are consumed in large parts of the world.

- In this pack, Feeder Cattle has been the best performer with 15.7 percent YTD gains after it was down almost 24 percent in 2016. Live Cattle is up 3.3 percent YTD.

- Lean hogs price is up 6.8 percent YTD.

- The worst performer has been Milk Class III (-13.5 percent).

This group was the worst performer last year with the average loss of 2.7 percent and this year, the pack is up 3.1 percent. The pack is down around 2.2 percent since our last review in November this year.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX