Gold -

Ichimoku Analysis (Weekly chart)

Tenken-Sen- $2059

Kijun-Sen- $1978

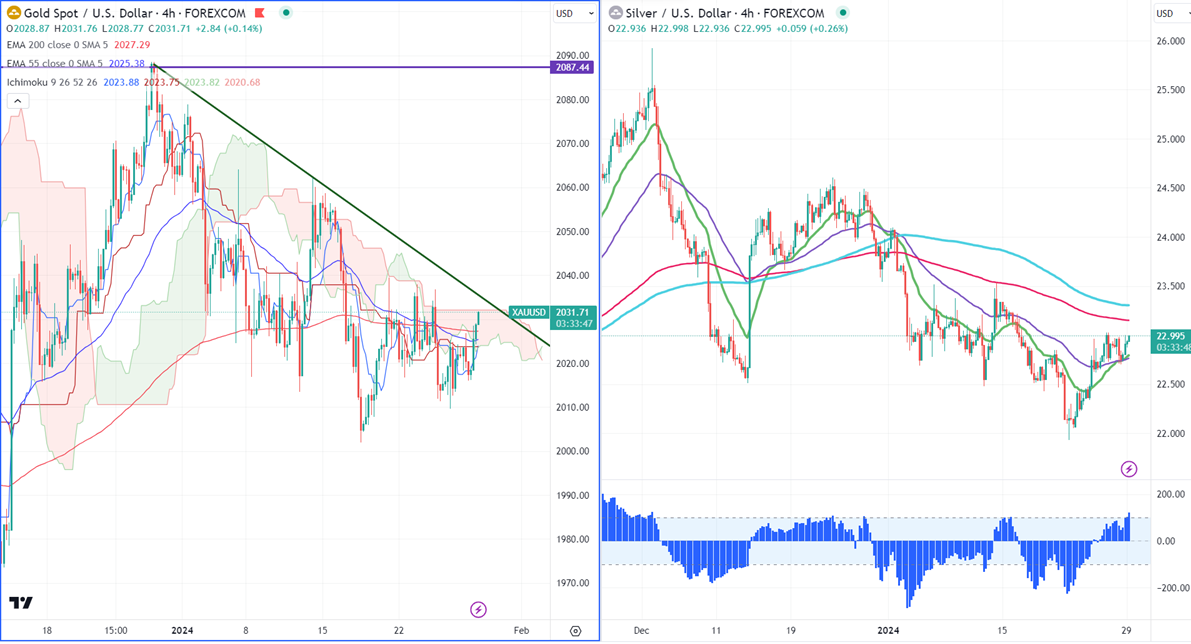

Gold trades in a narrow range between $2037.90 and $2009.40 for the past four days. US Advance GDP grew at a faster pace at 3.3%, compared to a forecast of 2%. US durable goods orders came unchanged in Dec. The Core PCE rose by 2.9% last month from 3.2% in Nov. The central bank kept its rates unchanged without making any changes in the policy statement. ECB President Lagarde said "The consensus around the table of the Governing Council was that it was premature to discuss rate cuts," The yellow metal hit a high of $2028 at the time of writing and is currently trading around $2027.64.

According to the CME Fed watch tool, the probability of a no-rate cut in Jan unchanged at 97.9% from 97.90% a week ago.

.

US dollar index- Bullish only if it closes above 103.69 (200-day EMA). Minor support around 103/102.40 The near-term resistance is 103.75/104.50.

Factors to watch for gold price action-

Global stock market- Bullish (negative for gold)

US dollar index - Mixed (Neutral for gold)

US10-year bond yield- Bullish (negative for gold)

Technical:

The near–term support is around $2015, a break below targets of $2000/$1970/$1956. The yellow metal faces minor resistance around $2040 and a breach above will take it to the next level of $2050/$2062/$2078.

It is good to buy on dips around $1988-90 with SL around $1970 for TP of $2065/$2080.

.

Silver-

Silver showed a nice pullback of more than $1 following footsteps of gold. It trades above 21 and 55- EMA and below long-term MA (200- EMA) in the 4-hour chart. Any close above $23.15 (200-4H EMA) confirms a bullish continuation. A jump to $23.60/$24 is possible. It is facing immediate support at around $22.50. Any break below target $21.90/$21.50.

Crude oil-

WTI crude oil prices traded above $78, the highest level since Sep due to the escalation of Redsea tension and upbeat US economic data.

Major resistance- $80/$83.50. Significant support- $77/$74.

Jan 25th, 2024, ECB monetary policy statement (1:15 pm GMT)

Advance US GDP q/q, US durable goods order (1:30 pm GMT)

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data