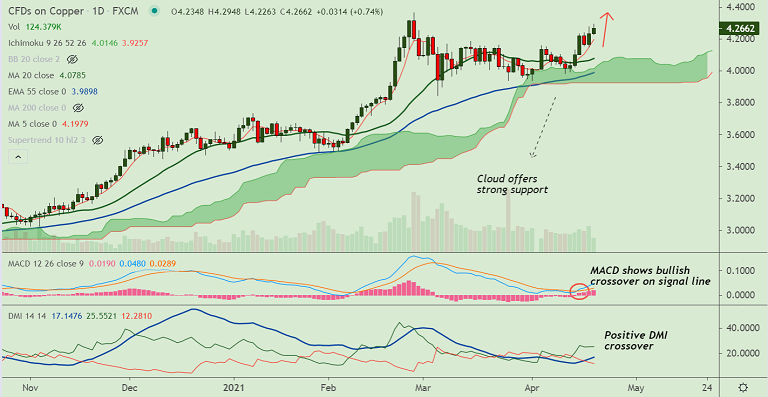

COPPER chart - Trading View

Copper has pared some gains for the day and has slipped lower from fresh multi-week highs at 4.294.

The pair was trading 0.64% higher on the day at 4.263 at the time of writing, extending previous session's gains.

Successful vaccine rollouts and easing of lockdowns in more countries is boosting hopes of a steady global economic recovery.

Technical bias for the pair is bullish. Pullback has bounced off cloud support and we see weakness only on break below.

Momentum has once again turned bullish. RSI has edged above the 60 mark, in support of the current uptrend.

MACD shows a bullish crossover on signal line and ADX support upside with +ve DMI crossover.

Scope for copper to refresh 2021 highs above 4.364 mark. 5-DMA is immediate support at 4.197. Bullish invalidation only below daily cloud.