Crude oil-

WTI crude oil pared some of its gains despite being weak in US inflation. US Headline rose 0.30% m/m in Jan, in line with the estimate. Core PCE came at 0.40%, matched forecasts.

Major factors for crude oil price movement-

US dollar index (Bearish)- Positive for Crude. Major resistance - 104.20/105. Major support- 103.40/102.80.

Geo-political tension- Uncertainty in ceasefire talks between Israel and Hamas. Attacks on Red Sea shipping by Houthi rebels.

Markets eye OPEC talks in Mar on possible extension of production cuts

Technicals

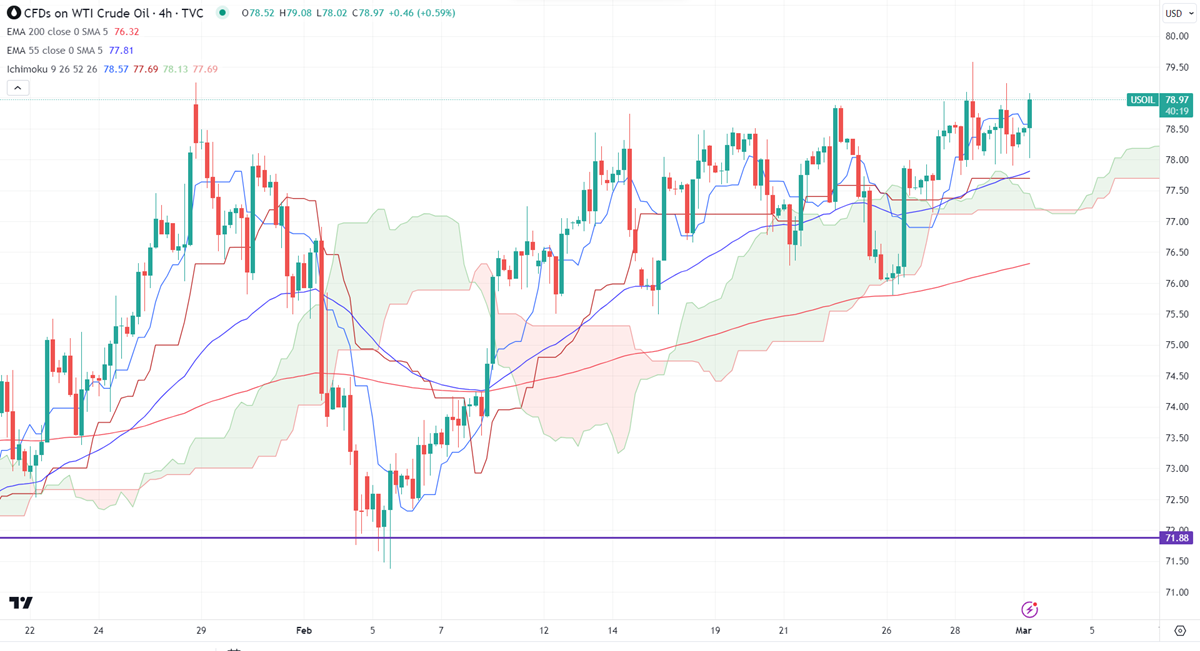

Ichimoku analysis (4- hour chart)

Tenken-Sen- $78.57

Kijun-Sen- $77.69

The immediate resistance is around $80. Any jump above $80 targets $83.50/$85. On the lower side, near-term support is around $77.70. Any breach below will drag the commodity down to $76/$75.51.

It is good to buy on dips around $75 with SL around $73 for TP of $80/$83.