WTI crude oil hits fresh year high due to supply disruptions. The commodity showed minor weakness after the weak US ISM manufacturing PMI. US Headline rose 0.30% m/m in Jan, in line with the estimate. Core PCE came at 0.40%, matched forecasts.

Major factors for crude oil price movement-

US dollar index (Bearish)- Positive for Crude. Major resistance - 104.20/105. Major support- 103.40/102.80.

Production cut- OPEC members agreed to extend 2.2 million barrels. Yemen-Iran-backed Houthis attacked a UK cargo vessel and promised to destroy more UK vessels.

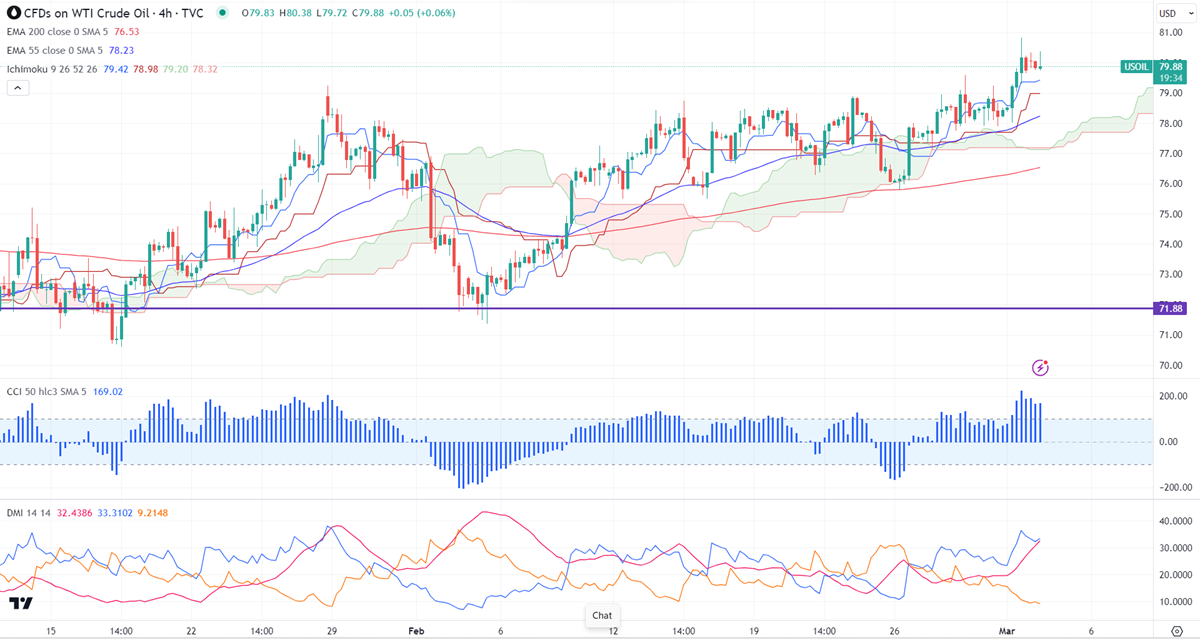

Ichimoku analysis (4- hour chart)

Tenken-Sen- $79.36

Kijun-Sen- $77.69

The immediate resistance is around $81. Any jump above $80 targets $83.50/$85. On the lower side, near-term support is around $77.70. Any breach below will drag the commodity down to $76/$75.51.

It is good to buy on dips around $75 with SL around $73 for TP of $80/$83.