WTI crude oil lost its shine and declined more than $2 from a multi-month high despite the weak US dollar. It hit a low of $80.94 at the time of writing and is currently trading at $80.93.

According to API, US crude oil inventories declined by about 1.519 million barrels for the week ended Mar 16th, compared to a build of 77000.

Major factors for crude oil price movement-

US dollar index (Bearish)- positive for Crude. Major resistance - 104.20/105. Major support- 103/102.40.

Geopolitical tension- Escalation of Russia and Ukraine war (Positive for crude)

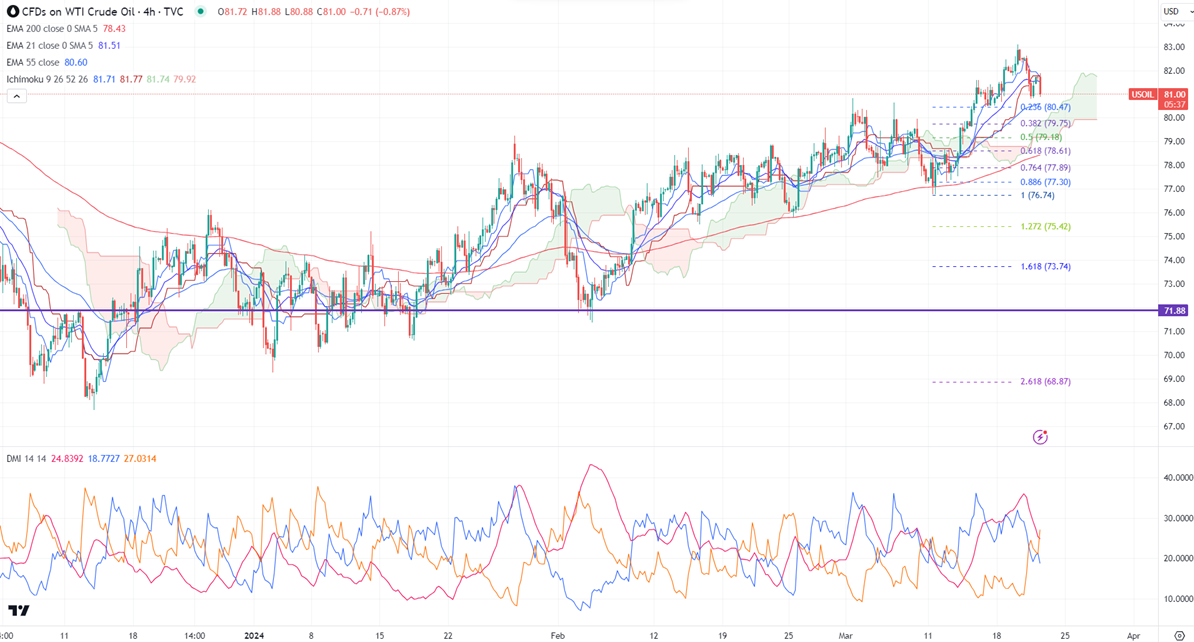

Ichimoku analysis (4- hour chart)

Tenken-Sen- $81.85

Kijun-Sen- $81.77

The immediate resistance is around $82. Any jump above targets $82.54/83.10. On the lower side, near-term support is around $80.80. Any breach below will drag the commodity down to $80.45/$80/$79.

It is good to buy on dips around $79.50 with SL around $77.90 for a TP of $83.50.