WTI crude oil recovered more than $1.5 on geopolitical tensions escalation. It hit a low of $84.81 yesterday and is currently trading at $85.93.

The fear of attack on Israel by Iran supports crude oil prices at lower levels. The International Energy Association lowered the 2024 oil demand by 130000 bpd to 1.2 million barrels per day.

Major factors for crude oil price movement-

US dollar index (Bullish)- negative for Crude. Major resistance - 105.20/106. Major support- 103.80/103.

Geopolitical tension- cease-fire talks progress between Israel and Hamas. (Negative for crude)

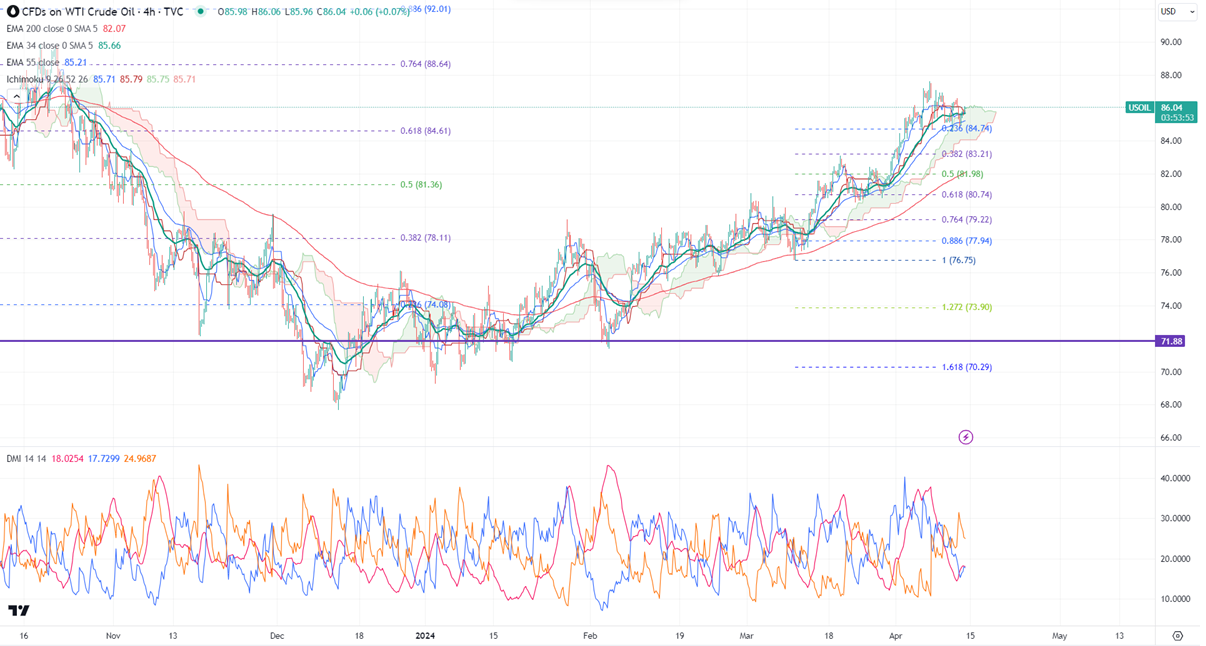

Ichimoku analysis (4- hour chart)

Tenken-Sen- $85.71

Kijun-Sen- $85.79

The immediate resistance is around $86.60. Any jump above targets $87.20/$88.25/$90. On the lower side, near-term support is around $85.60. Any breach below will drag the commodity down to $85/$84.50/$84/$83.20.

It is good to buy on dips around $85 with SL around $84 for a TP of $87.20.