Crude oil gained sharply on supply concerns. It hit a high of $77.55 yesterday and is currently trading around $75.60.

Libya’s eastern government in Benghazi said that oil production and exports would be halted due to fighting for control of the Central Bank. Libya exports more than 1 million bpd.

Major factors supporting higher Crude oil price

US dollar index - Bearish

US treasury yield- weak (positive for commodity market).

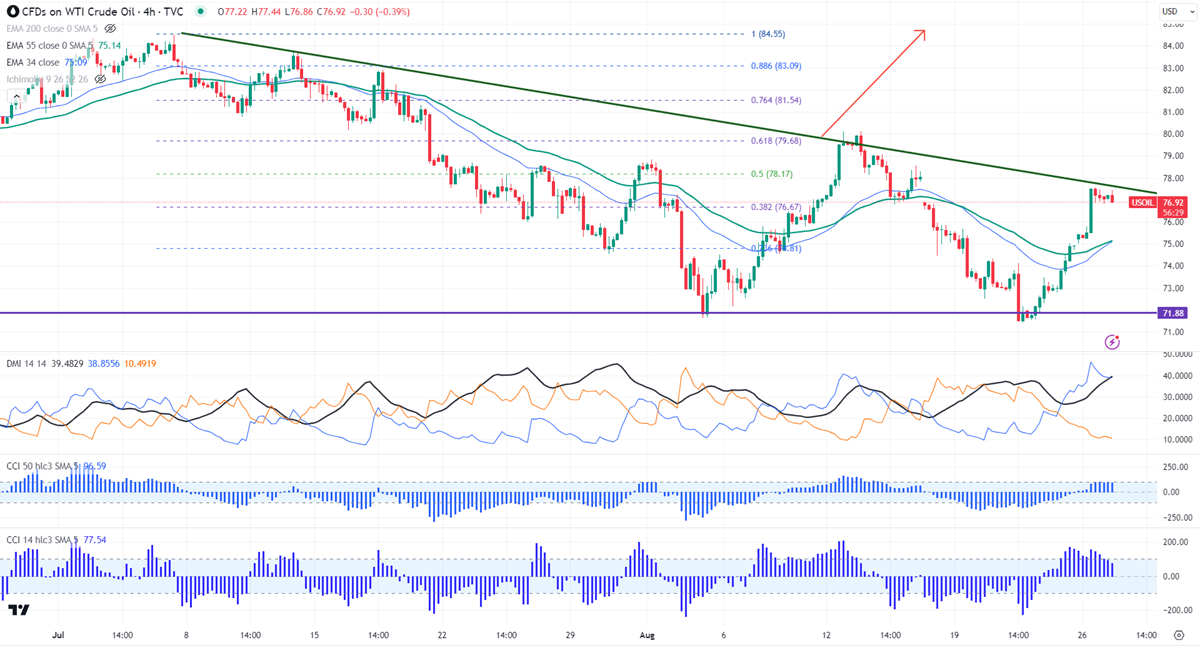

Major resistance- $78. Any breach above will take the commodity to the next level of $79/$80. Major trend reversal only above $84.50.

The near-term support is around $74.60 (55- 4H EMA), any violation below targets $74.10 (34- 4H EMA)/$73.65/$73.

Indicators (4- hour chart)

ADX- Bullish (4-hour chart)

CCI (50) and CCI (14)- Bullish (4- hour chart)

It is good to buy on dips around $76 with SL around $74.90 for TP of $78.