Crude oil - Commodity of the week

Crude oil dropped more than $1.50 from a high of $70.61 on demand concerns. It hit a low of $68.48 and is currently trading around $69.03.

According to the US Bureau of Safety and Environmental Enforcement, hurricane Francine halts around 12% crude oil output.

Chinese refiners processed 59.07 million metric tons of crude last month equivalent to 13.91 million bpd compared to 15.23 million bpd a year earlier.

US dollar index - Bearish

US treasury yield- bearish (positive for commodity market).

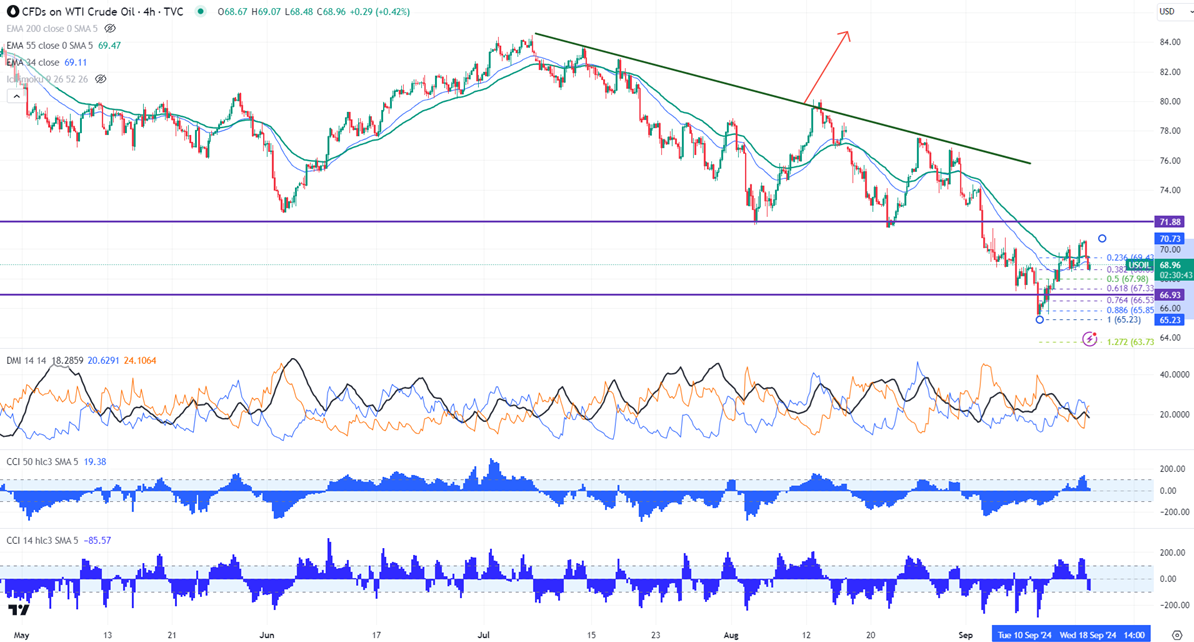

Major resistance- $70.90. Any breach above will take the commodity to the next level $71.37/$71.70/$72.80/$73.20. Major trend reversal only above $78.

The near-term support is around $68, and any violation below targets $67/$65.

Indicators (4- hour chart)

ADX- Neutral

CCI (50) - Bullish

CCI (14)- Bearish

It is good to sell on rallies around $70 with SL around $70.90 for TP of $67.