Previous Week

The Yen, gold continues to shine as a corona virus death toll increased to 304. China has recorded 2590 cases on Feb 1st and total number of infected people exceeded 17000.Lot of countries has blocked airlines services to China. The yen is trading higher for past 2-weeks and lost nearly 200 pips.

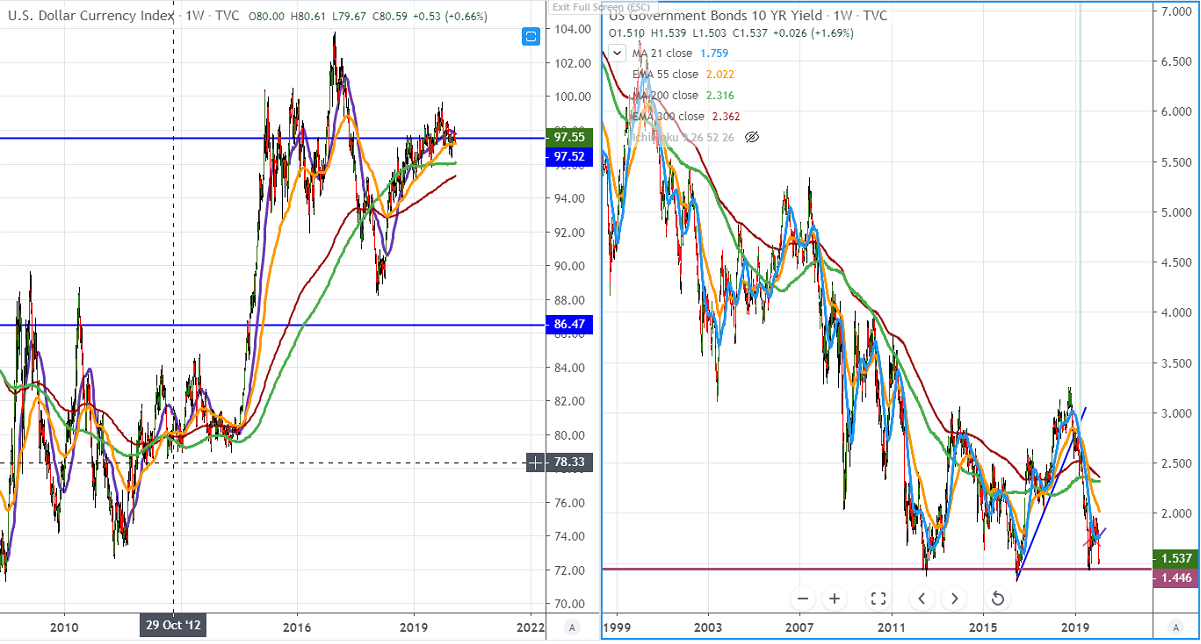

DXY has halted its 2-weeks of bullishness and declined more than 80 pips. The index is facing strong support at 97.30 and any violation below targets 97/96.60. It is currently trading around 97.49.

The US Conference Board consumer confidence came at 131.6 in Jan, the highest level in 5 months. The durable goods orders surged 2.4% in Dec vs forecast of 1.2%. US Fed has kept its rates unchanged at 1.50%-1.75% as widely expected and said in the press conference that the current monetary stance is "appropriate". The central bank also added about coronavirus that it is "very carefully monitoring the situation", but "too early" to assess the impact.

The precious metal has recovered sharply more than $20 from previous week close of $1571. Any break above $1588 confirms bullish continuation, a jump till $1600/$1611 likely.

US 10 year bond yield is trading weak for the past 2-week and lost more than 11% from high of 1.69%. The spread between US 10- year and 2 years has narrowed to 19 bps from 35.7 bps.

Weekly Technical:

EURUSD:

Major trend reversal level- 1.1180

Near term support- 1.0980/1.0880

Near term resistance – 1.1120/ 1.1180

USDJPY:

Major trend reversal level- 107.80

Near term support- 108.30/107.80

Near term resistance – 109.75/110.30

USDCHF

Major trend reversal level- 0.9600

Near term support- 0.9540/0.9500

Near term resistance – 0.9700/0.9770

USDCAD

Major trend reversal level- 1.3250

Near term support- 1.3180/1.3100

Near term resistance – 1.3180/1.3300

Gold

Major trend reversal level- $1611

Near term support- $1560/$1535

Near term resistance – $1611/$1640

WTI Crude

Major trend reversal level- $50

Near term support- $50/$43

Near term resistance – $55/$57.60

Major Economic events for the week

US ISM – Monday (3:00 pm)

US ADP Employment - Wed (1:15 pm GMT)

US ISM Services PMI –Wed (3:00 pm GMT)

CAD –Employment Friday (1:30 pm GMT)

US Non-farm employment change - Friday (1:30 pm GMT)

USD Employment rate – Friday (1:30 pm GMT)