- DAX index has closed slightly on the lower side yesterday around 0.74% low. US markets was closed yesterday due to President’s day. S&P500 futures is trading slightly up and is trading around 2732. Asian stock indices are trading slightly weak on account of strengthening of US dollar. S&P500 has closed slightly above 2725 and this confirms minor bullishness a jump till 2800 is likely. It is trading around 2732 0.13% higher. Overall weakens can be seen only below 2530 level.

- DAX index jumped almost 300 points in the previous week and has closed yesterday at 12393.

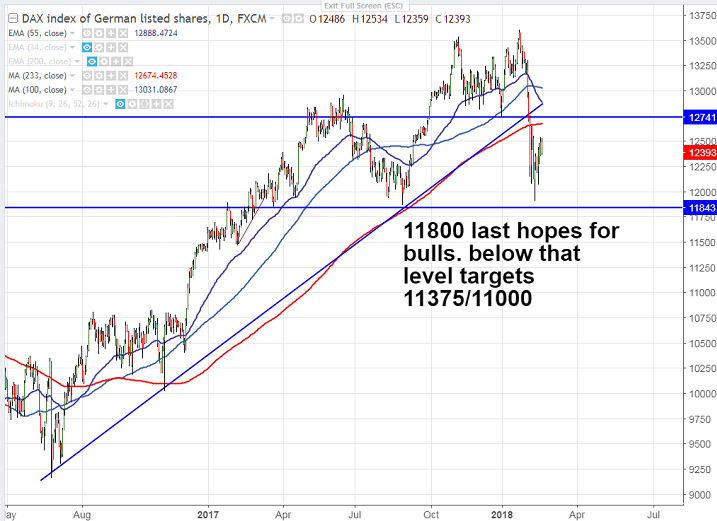

- The minor bullishness can be seen only if it closes above 12660 (233- day MA) and any close above will take the index to next level till 12890/13050 (100- day MA). It should break above 13600 for further bullishness.

- On the lower side, near term major support is around 11800 and any break below will drag the index till 11400/11000.

It is good to buy on dips around 12200-250 with SL around 12000 for the TP of 12660/13000.