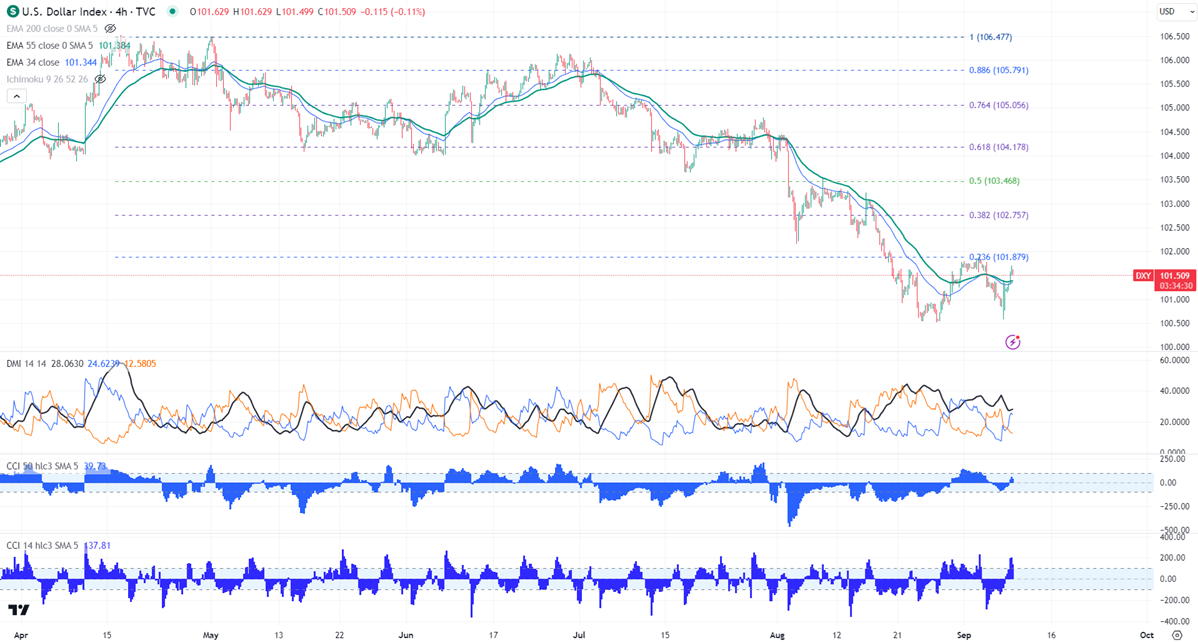

Major support- 100

Major resistance- 102

DXY showed a minor sell-off after a nice pullback. It hit a high of 101.91 and is currently trading around 101.51.

According to the CME Fed watch tool, the probability of a 25 bpbs rate cut in Sep increased to 75% from 70% a week ago.

On the lower side, near-term support is around 101.20 and the violation below will drag the index down to 101.20/100.60/100/99.57/99/98. Significant resistance is around 102 and breach above targets 102.75/103.22. Overall bearish invalidation only above 104.

Indicator (4-hour chart)

CCI (14)- Bullish

CCI (50)- Bullish

It is good to sell on rallies around 101.78-80 with SL around 102.40 for TP of 100.