Short term trend – Bullish

Intraday trend – Bullish

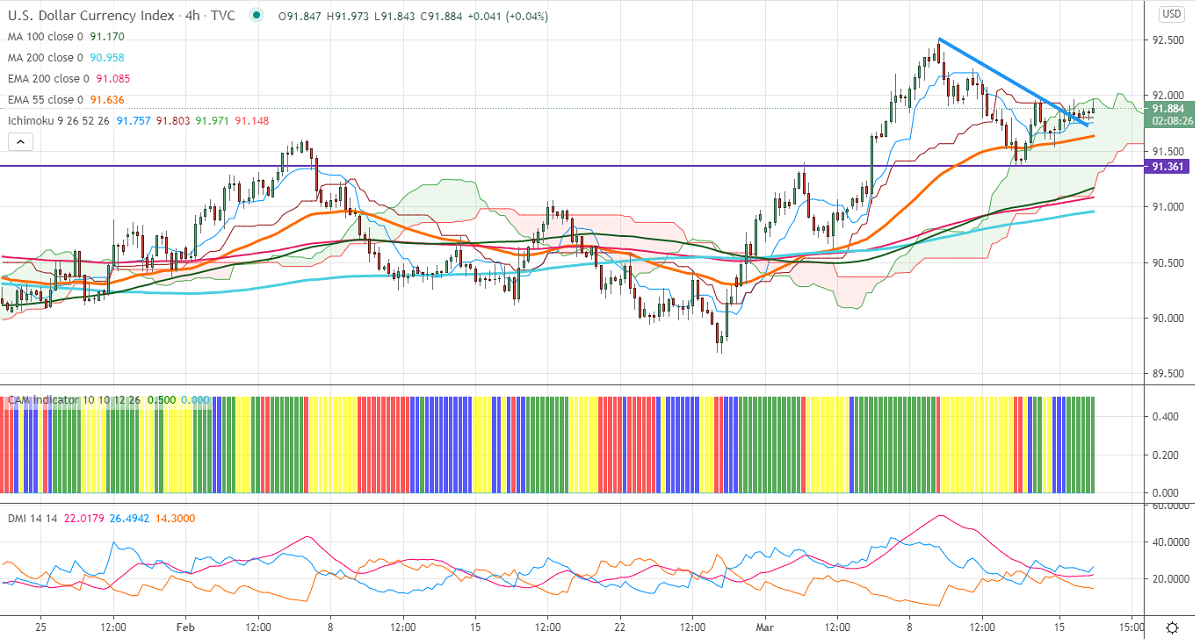

Ichimoku Analysis (4-Hour chart)

Tenken-Sen- 91.75

Kijun-Sen- 91.80

US Dollar index is consolidating in a narrow range after hitting a high of 91.96. The surge in US 10- year bond yield is supporting the US dollar at lower levels. US Empire state manufacturing index jumped to 17.4 in Mar, hits the highest level in 8 months compared to a forecast of 12.1. Markets eye US retail sales data for further direction. The index hits an intraday high of 91.97 and is currently trading around 91.883.

The near-term resistance is around 92.25, convincing close above confirms minor bullishness. A jump to 92.76 (161.8% fib)/93 is possible.

The index is trading slightly below 91.60; any indicative break below will take the index to 91.36/90.95/90.50.

Ichimoku analysis- DXY is trading above 4- Hour Tenken-Sen and Kijun –Sen. It is holding below the Ichimoku cloud (91.95).

Indicator (4 Hour chart)

CAM indicator – Bullish

Directional movement index –Bullish

It is good to buy on dips around 91.55-57 with SL around 91 for a TP of 92.50.