Short term trend – Bullish

Intraday trend – Bearish

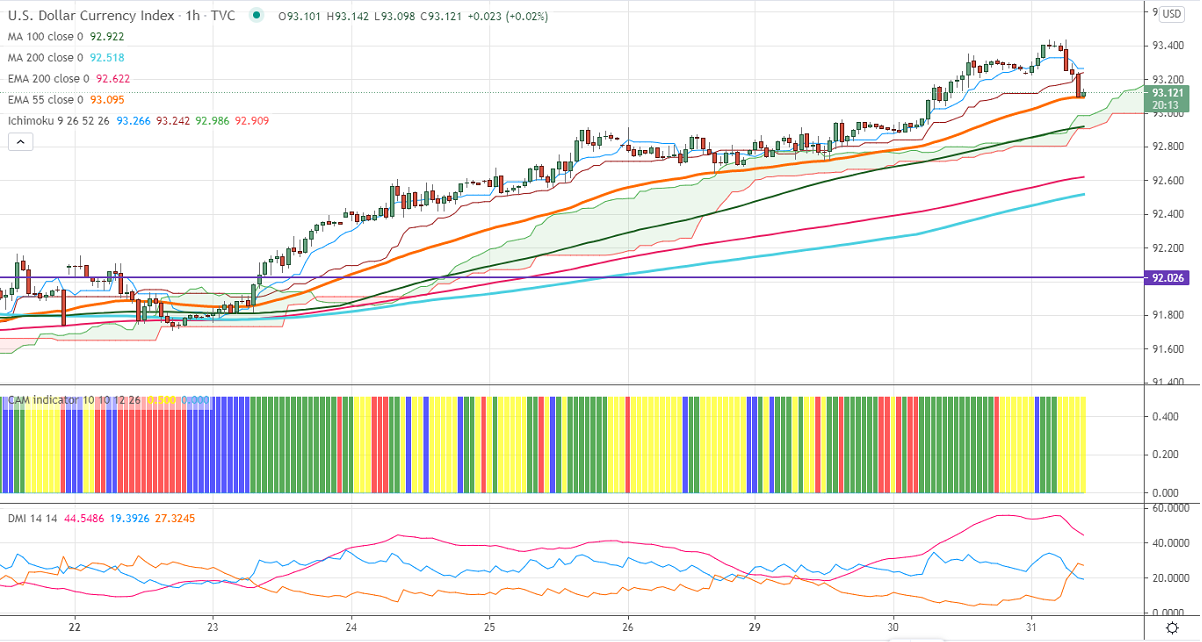

Ichimoku Analysis (1-Hour chart)

Tenken-Sen- 93.26

Kijun-Sen- 93.23

US Dollar index is trading higher for the past ten days and jumped more than 200 pips on board-based on US dollar buying. The surge in US 10- year bond yield is supporting the US dollar at lower levels. The yield rose sharply in a short period and crossed the 1.75% level. Markets eye US ADP employment and pending home sales data for further direction. The Conference Board Consumer confidence came at 109.70 in Mar, the highest level in one year. The index hits an intraday high of 93.43 and is currently trading around 93.11.

The near-term resistance is around 93.50, convincing close above confirms minor bullishness. A jump to 94/94.30 is possible.

The index is trading slightly below 92.50; any indicative break below will take the index to 92/91.60/91.30.

Ichimoku analysis- DXY is trading slightly below 1- Hour Tenken-Sen and Kijun –Sen. Any indicative violation below 92.90 confirms intraday weakness.

Indicator (1 Hour chart)

CAM indicator – neutral

Directional movement index –neutral

It is good to sell on rallies around 93.20-25 with SL around 93.60 for a TP of 92.50.