Short term trend – Bearish

Intraday trend –Bearish

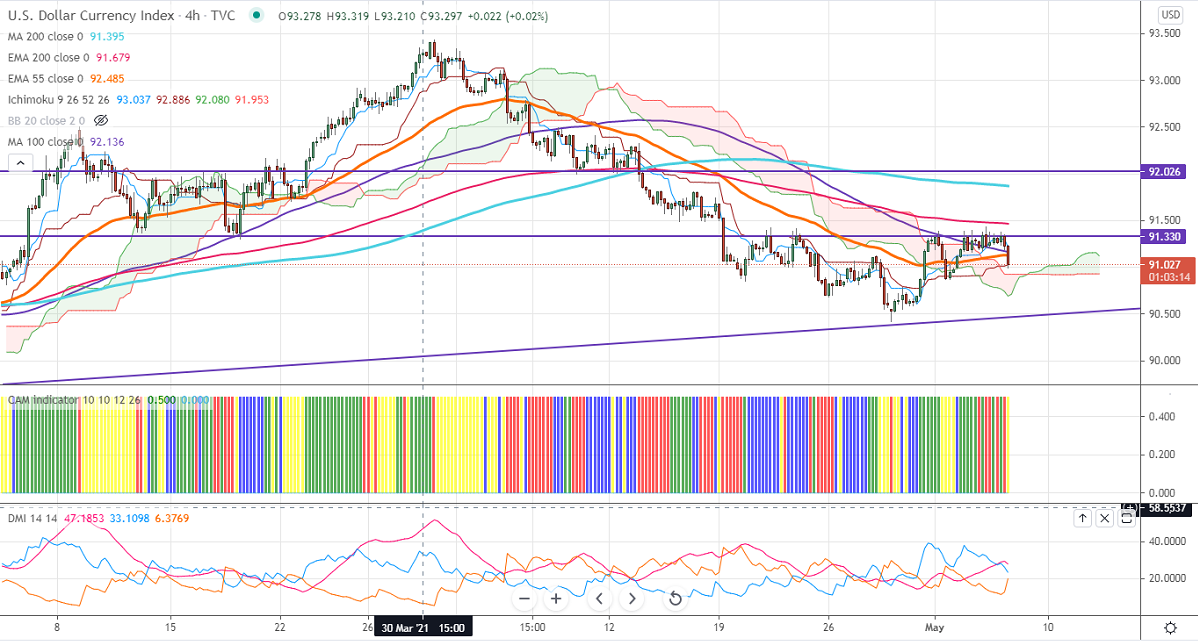

Ichimoku Analysis (4-Hour chart)

Tenken-Sen- 91.30

Kijun-Sen- 91.014

US Dollar index has shown a minor sell-off from a high of 91.43. The index hits an intraday low of 91 and is currently trading around 91.02. The number of private-sector jobs rose to 742000 in Apr compared to a forecast of 872K. The US ISM services PMI came at 62.7% in Apr slightly below the estimate of 64.2. The dollar index surged sharply from a low of 90.42 on upbeat US economic data and hopes of a rate hike by the Fed. The slight decline in US bond yields is putting pressure on the US dollar index at higher levels.

The near-term resistance is around 91.47 (200-4H EMA), convincing close above confirms minor bullishness. A jump to 91.87/92.44 is possible.

On the lower side, immediate support stands at 90.85, any indicative break below will take the index to 90.40/90/89.79.

Ichimoku analysis- DXY is trading slightly below 4-hour Tenken-Sen. But holding above Kijun –Sen, and cloud. Any indicative violation below 90.40 confirms further bearishness

Indicator (1 Hour chart)

CAM indicator – Bearish

Directional movement index –Neutral

It is good to sell on rallies around 91.22-25 with SL around 91.50 for a TP of 90.