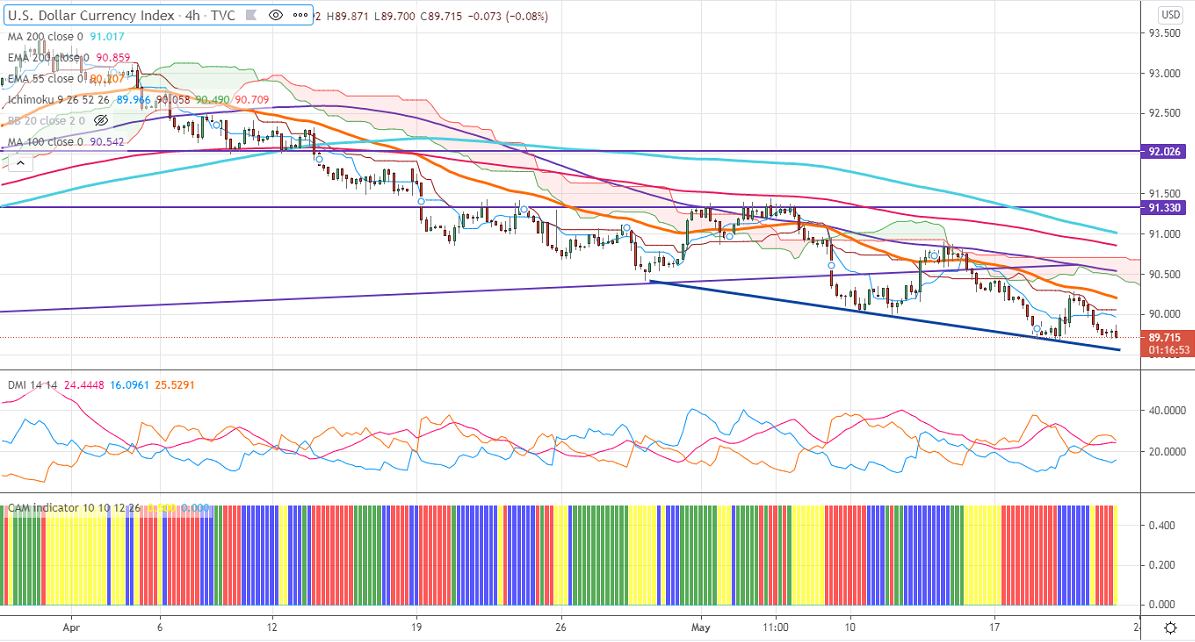

Short term trend – Bearish

Intraday trend –Bearish

Ichimoku Analysis (4-Hour chart)

Tenken-Sen- 89.99

Kijun-Sen- 90.05

US Dollar index declined once again after a minor pullback till 90.28. The dollar gained slightly after Fed members gave hint about bond tapering in FOMC meeting minutes. The decline in US bond yield and slight weak economic data is dragging the US dollar further down. The number of people who have filed for unemployment benefits declined to 444000 the previous week compared to a forecast of 453K. The Philadelphia Federal reserve business activity fell to 31.5 in May from 50.2 in Apr. Markets eye US flash manufacturing PMI for further direction.

The near-term resistance is around 90.30 (55-4H EMA), convincing close above confirms minor bullishness. A jump to 90.63/90.80 is possible.

On the lower side, immediate support stands at 89.69, any indicative break below will take the index to 89.20/89.

Ichimoku analysis- DXY is trading slightly below 4-hour Tenken-Sen, Kijun-Sen and cloud.

Indicator (4 Hour chart)

CAM indicator – Bearish

Directional movement index –Bearish

It is good to sell on rallies around 90 with SL around 90.35 for a TP of 89.