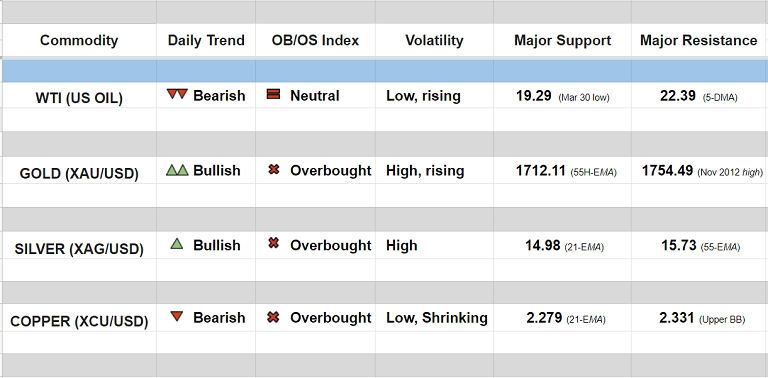

Daily Commodity Tracker (12:00 GMT)

WTI (US OIL):

Major and Minor trend - Strongly bearish

Oscillators: Neutral (bias lower, approaching oversold)

Bollinger Bands: Volatility Rising on Daily, Weekly and Monthly charts

Intraday High/Low: 20.90/ 19.70

GOLD (XAU/USD):

Major and Minor trend - Strongly bullish

Oscillators: At overbought

Bollinger Bands: Volatility Rising on Daily, Weekly and Monthly charts

Intraday High/Low: 1731.474/ 1708.284

SILVER (XAG/USD):

Major trend - Neutral; Minor trend - Strongly Bullish

Oscillators: At overbought (turning South)

Bollinger Bands: Volatility Rising on Weekly and Monthly charts

Intraday High/Low: 15.78/ 15.35

COPPER (XCU/USD):

Major trend - Neutral; Minor trend - Turning Bearish

Oscillators: At overbought (On verge of rollover)

Bollinger Bands: Volatility Shrinking on Daily charts, Rising on Weekly and Monthly charts

Intraday High/Low: 2.328/ 2.278

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields