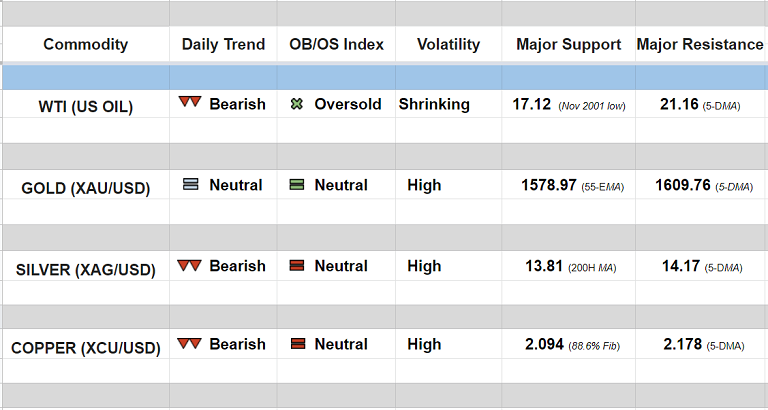

Daily Commodity Tracker (12:00 GMT)

WTI (US OIL):

Major and minor trend - Strongly bearish

Oscillators: Oversold (no sign of reversal)

Bollinger Bands: Shrinking on Daily charts, Widening on Weekly and Monthly charts

Intraday High/Low: 20.78/20.02

GOLD (XAU/USD):

Major and minor trend - Neutral

Oscillators: Neutral (Bias turning lower)

Bollinger Bands: High volatility

Intraday High/Low: 1600.738/ 1573.059

SILVER (XAG/USD):

Major and minor trend - Strongly bearish

Oscillators: Neutral (Flat)

Bollinger Bands: Shrinking on Daily charts, Widening on Weekly and Monthly charts

Intraday High/Low: 14.14/ 13.85

COPPER (XCU/USD):

Major and minor trend - Strongly bearish

Oscillators: Neutral (near oversold)

Bollinger Bands: Shrinking on Daily charts, Widening on Weekly and Monthly charts

Intraday High/Low: 2.204/ 2.164

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics