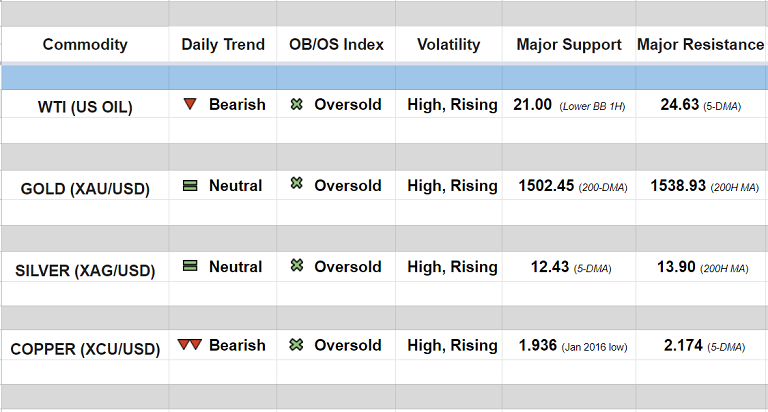

Daily Commodity Tracker (12:30 GMT)

WTI (US OIL):

Major and minor trend - Strongly bearish

Oscillators: Oversold (no sign of reversal)

Bollinger Bands: Widening on Daily, Weekly and Monthly charts

Intraday High/Low: 23.60/ 20.84

GOLD (XAU/USD):

Major trend - Neutral; Minor trend - Neutral

Oscillators: Oversold (no sign of reversal)

Bollinger Bands: Widening on Daily charts

Intraday High/Low: 1523.679/ 1482.790

SILVER (XAG/USD):

Major trend - Strongly bearish, Minor trend - Neutral

Oscillators: Oversold (on verge of rollover into neutral)

Bollinger Bands: Widening on Daily, Weekly and Monthly charts

Intraday High/Low: 12.9909/ 12.2846

COPPER (XCU/USD):

Major and minor trend - Strongly bearish

Oscillators: Oversold (no sign of reversal)

Bollinger Bands: Widening on Daily, Weekly and Monthly charts

Intraday High/Low: 2.144/ 2.019

FxWirePro: Daily Commodity Tracker - 20th March, 2020

Monday, March 23, 2020 12:47 PM UTC

Editor's Picks

- Market Data

Most Popular

Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed