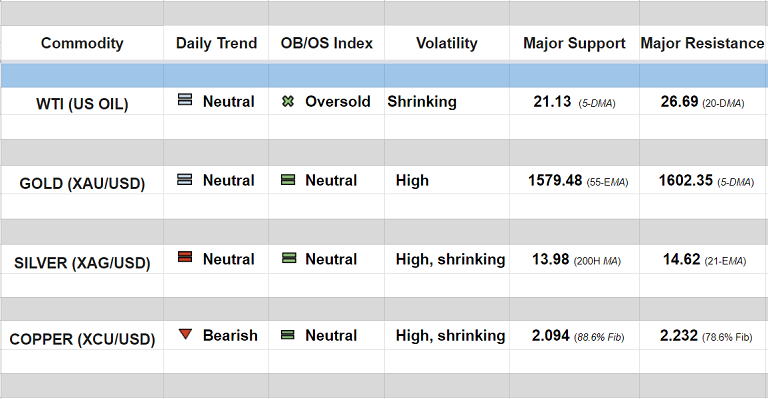

Daily Commodity Tracker (12:00 GMT)

WTI (US OIL):

Major trend - Strongly bearish; Minor trend - Neutral

Oscillators: Oversold (on verge of rollover into neutral)

Bollinger Bands: Shrinking on Daily charts, Widening on Weekly and Monthly charts

Intraday High/Low: 22.53/20.80

GOLD (XAU/USD):

Major and minor trend - Neutral

Oscillators: Neutral (Bias neutral)

Bollinger Bands: Volatility high, shrinking on the daily charts

Intraday High/Low: 1599.418/ 1583.224

SILVER (XAG/USD):

Major trend - Strongly bearish; Minor trend - Neutral

Oscillators: Neutral (Bias higher)

Bollinger Bands: Shrinking on Daily charts, Widening on Weekly and Monthly charts

Intraday High/Low: 14.29/ 13.90

COPPER (XCU/USD):

Major and minor trend - Strongly bearish

Oscillators: Neutral (Bias higher)

Bollinger Bands: Shrinking on Daily charts, Widening on Weekly and Monthly charts

Intraday High/Low: 2.202/ 2.150

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?