USD has been waiting for December month very cautiously, we reckon dollar is likely to be supported next week as the FOMC minutes (Wednesday) validate the readiness of the board to begin the monetary normalization cycle as soon as December.

With fed fund futures already pricing about a 70% chance of a hike this year, we would expect a modest upward move in the USD as the market fully prices in December as the lift-off date.

Inflation on Tuesday should point in the same direction, showing core CPI running close to 2.0% YoY with strong readings in service related sectors, which will probably stay near 3%.

Finally, on the same day, we expect manufacturing production to show an increase of 0.2% MoM despite continued USD strength. Overall, we remain constructive on the outlook for the US economy.

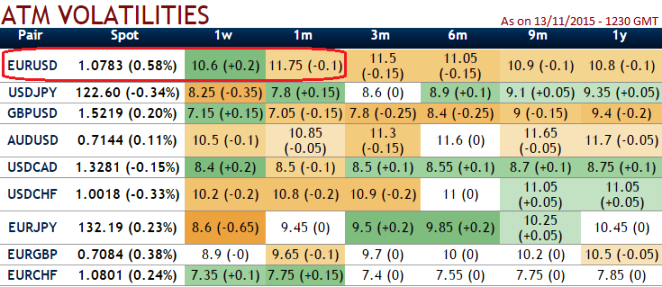

As you can see from the nutshell showing implied volatilities of ATM contracts (EURUSD of next month's expiries show 11.75% which is the highest among G20 majors).

With consistent losing streak of EURUSD, we recommend on speculation basis buying one touch vega puts in order to extract leverage on extended profits.

So by employing these Vega options one can not only multiply the returns by twice, thrice or even pour returns unimaginably but also upbeat the implied volatility. But do remember this call is strictly on speculative grounds.

The prime merits of such one touch option spreads are high yields during high volatility plays. Wider spreads indicates lack of liquidity.

The spreads for one touch EUR/USD options are constant time and barrier levels. We believe one touch Vega spreads can be the best suitable options to trade HY vols.

Usually, such binary options for every change in 1 pip the relative change in option price 0.01% or even exponential at high implied volatility times.

FxWirePro: Dollar curiosity in December keeps IV higher - EUR/USD vega spreads to trade HY vols

Monday, November 16, 2015 12:28 PM UTC

Editor's Picks

- Market Data

Most Popular

Bitcoin Stuck in $66K–$67K Cage – Break $70K and $78K+ Becomes the Prize

Bitcoin Stuck in $66K–$67K Cage – Break $70K and $78K+ Becomes the Prize  EUR/JPY Coils Tightly Above 183.20 – Bulls Ready to Push Toward 186

EUR/JPY Coils Tightly Above 183.20 – Bulls Ready to Push Toward 186  FxWirePro- Major European Indices

FxWirePro- Major European Indices  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  FxWirePro: GBP/NZD attracts selling interest, vulnerable to more downside

FxWirePro: GBP/NZD attracts selling interest, vulnerable to more downside  FxWirePro: AUD/ USD edges up as Australian dollar gains on hawkish RBA outlook

FxWirePro: AUD/ USD edges up as Australian dollar gains on hawkish RBA outlook  FxWirePro: NZD/USD edges up, remains on front foot

FxWirePro: NZD/USD edges up, remains on front foot  ETH Follows BTC Higher: $2056 and Climbing – Bulls Locked In Above $2000

ETH Follows BTC Higher: $2056 and Climbing – Bulls Locked In Above $2000  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Pound Sell-Off Accelerates: GBP/JPY Drops to 209.93, Eyes Major Support Zone

Pound Sell-Off Accelerates: GBP/JPY Drops to 209.93, Eyes Major Support Zone  FxWirePro: USD/ZAR edges higher but bearish outlook persists

FxWirePro: USD/ZAR edges higher but bearish outlook persists  FxWirePro: GBP/NZD downtrend loses steam but outlook still bearish

FxWirePro: GBP/NZD downtrend loses steam but outlook still bearish  FxWirePro- Major Pair levels and bias summary

FxWirePro- Major Pair levels and bias summary  AUDJPY Reclaims 111 Handle: Bulls Eye 112 Target After Dip

AUDJPY Reclaims 111 Handle: Bulls Eye 112 Target After Dip  NZDJPY Retraces on Tokyo CPI: Bulls Eye 95.00 Target as Support Holds

NZDJPY Retraces on Tokyo CPI: Bulls Eye 95.00 Target as Support Holds