The dollar is downgraded further in the forecasts, this month across most of EM and also CAD. The most significant forecast change in G10 was a shift in directional views in CAD. The US continues to lag the growth upgrade cycle, prompting yet another 2% downgrade to the USD TWI forecast. FX forecast revisions in the past month have been dominated by EM with nearly 60% of the universe upgraded led by Asia. Thereby, the dollar has experienced yet another month of broad-based weakness pushing the trade-weighted index to a new 2-year low.

The flow of funds into and out of Mutual Funds and ETFs in all asset classes has been monitored by SG.

And it indicates that the favorable risk environment spurred net inflows, during the summer months, overall low equity volatility and falling bond yields supported net inflows in most asset classes, notably into US bond funds. Meanwhile, net outflows from US equity funds were the main exception, as further rises in the S&P could not compensate for the weakening of the dollar (-8% versus the euro since June).

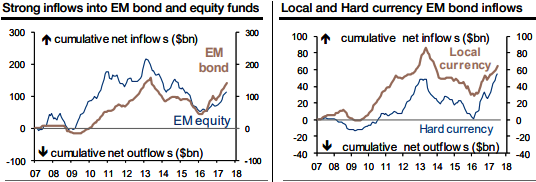

EM funds benefited most: Seemingly undeterred by the buildup of risks related to Russia and North Korea, net inflows into EM funds were among the main beneficiaries of the weakening dollar. Falling correlation in global financial markets probably also added to the drive for geographical diversification in portfolios. Both EM equity and EM bond funds attracted strong net inflows (chart below on the left).

EM bond funds star performers: With net inflows of $27bn over the last three months, representing 4.1% of assets under management (AuM), EM bonds funds were again a star performer across assets during the summer months. Both local currency and hard currency EM bond funds attracted strong net inflows (chart below on the right).

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025