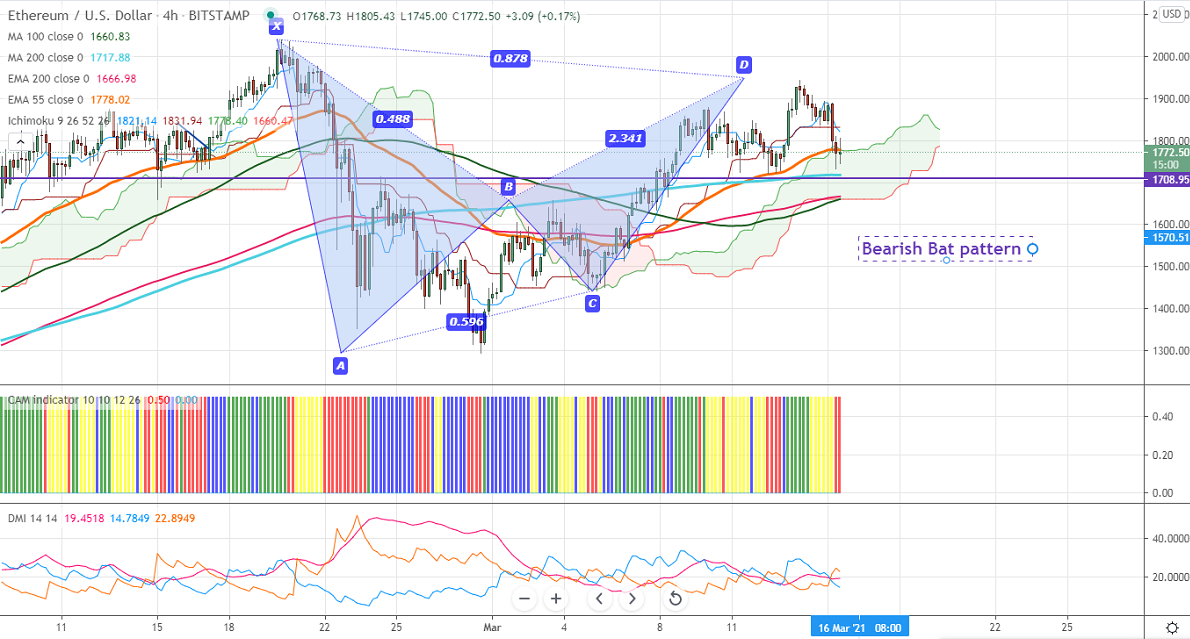

Harmonic Pattern- Bearish Bat

Ichimoku analysis (4-Hourly chart)

Tenken-Sen- 1831.80

Kijun-Sen- 1831.94

ETHUSD is consolidating after hitting a multi-year high at $2040. The pair was one the best performer in past one year and surged more than $1900. Short term trend of this pair is bearish as long as resistance $2040 holds. It has formed minor top around $1940 and started to decline from that level.

On the lower side, ETHUSD is facing strong support around $1720 and any violation below will drag the pair down to $1665 (200-4H EMA)/$1600/$1562 (55- 4H EMA).

The near-term resistance is at $1850, any indicative break above targets $1900/$1940.Significant trend continuation only above $2040.

Ichimoku Analysis- The pair is trading above Kijun-Sen, Tenken-Sen, and cloud. This confirms minor bullishness.

Indicator (Hourly chart)

CAM indicator – Bearish

Directional movement index – Bearish

It is good to sell on rallies around $1875-80 with SL around $2040 for TP of $1565.