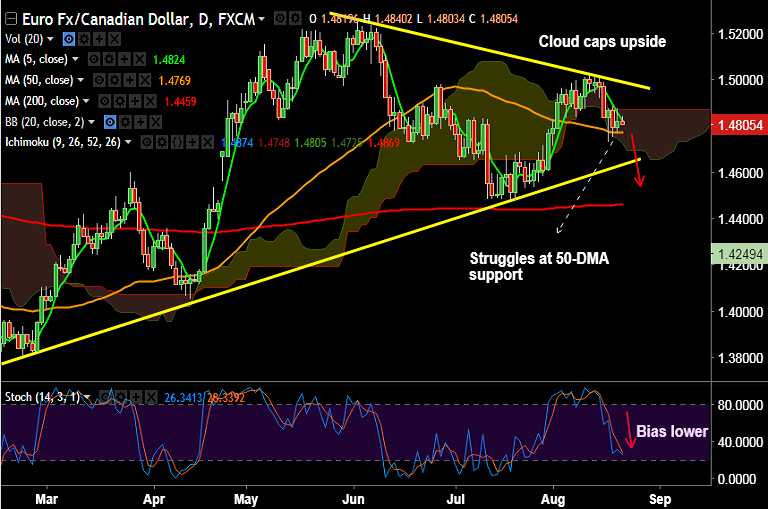

- EUR/CAD bias bearish as long as price action remains below 20-DMA at 1.4849.

- Technical indicators are bearish. RSI and stochs are biased lower while MACD shows bearish crossover on signal line.

- The pair is extending decline in a symmetric triangle pattern, break below 50-DMA raises scope for test of triangle base.

- Breach of triangle base then eyes 200-DMA at 1.4459.

- Upside remains capped by daily cloud at 1.4869. We see gains only on break above.

Support levels - 1.4769 (50-DMA), 1.4630 (trendline), 1.4459 (200-DMA)

Resistance levels - 1.4824 (5-DMA), 1.4869 (cloud top), 1.4985 (trendline)

Recommendation: Good to go short on decisive break below 50-DMA, SL: 1.4870, TP: 1.4630/ 1.46/ 1.4535/ 1.4460

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest.