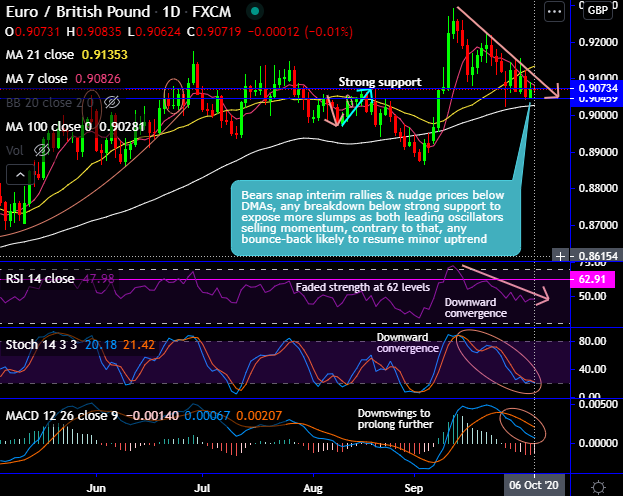

EURGBP bears in the minor trend, snap interim rallies & nudge prices below DMAs, thereby, minor uptrend seems to be exhausted (refer daily chart).

Furthermore, any breakdown below strong support of 0.9045 levels to expose more slumps as both leading oscillators signal selling momentum, contrary to that, any bounce-back likely to resume the minor uptrend.

On a broader perspective, hammer (at 0.8469 levels) takes-off rallies above EMAs, while bulls in the major trend attempt to breakout prolonged range-bounded trend but now give up 11-years highs. In this bullish journey, the pair has recovered its gains in just 2-months (i.e. the rallies that were wiped off from the last 6-months).

The prevailing prices have settled in the lower range between the 0.9500 highs around 0.9200 lows. A decline through 0.8975-0.8930 is needed to suggest a deeper setback towards 0.8750–0.8600 is developing.

Otherwise, pullbacks have held near term support levels and if prices merely develop into a sideways range, another leg higher is likely to follow. Next focal point above 0.9500 is the 0.9802 high from 2008 and then 1.00. We expect that upper region to provide resistance.

Overall, we are monitoring current price action to determine whether the move to 0.9500 was a false break of the medium-term range highs, or whether we test above 0.9802 level.

Trade tips: On trading perspective, at spot reference: 0.9069 levels, contemplating above explained technical rationale, it is advisable to trade tunnel spread option strategy using upper strikes at 0.9123 and the lower strikes at 0.9040 levels, the strategy is likely to fetch leveraged yields as long as underlying spot FX keeps dipping towards lower strikes but remains above that level on the expiration.

Alternatively, on hedging grounds we advocated initiating EURGBP longs in futures of April’2020 delivery, shorts in our earlier directional hedges have delivered now as desired moves. We wish to maintain long positions for now with a view of arresting upside risks.