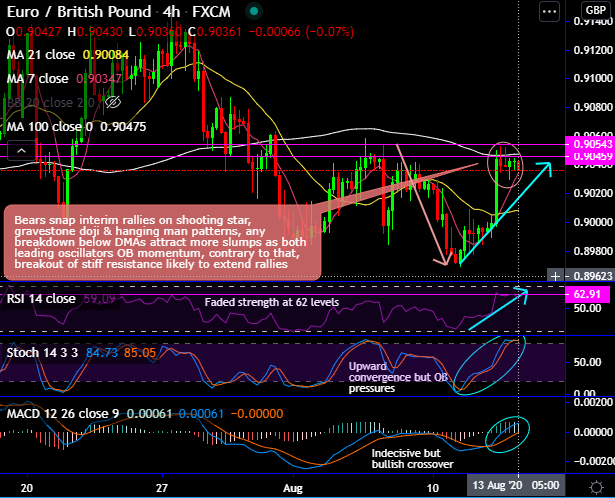

EURGBP remain under pressure, but are now in the lower region of the current 0.8940/30 to 0.9185 range.

Technically, the bears snap interim rallies upon shooting star, gravestone doji & hanging man patterns.

Any breakdown below DMAs could attract more slumps as both leading oscillators (RSI & Stochastic curves) signal overbought momentum. Contrary to this stance, breakout of stiff resistance likely to extend rallies.

Shooting star forms at 0.9039, gravestone doji at 0.9038 and hanging man at 0.9042 levels.

Stiff resistance is observed at 0.9045 – 0.9054 areas (refer 4H chart).

Overall, the short-term studies have been suggesting that there is still a risk of both upside and downside movement (upside above 0.9054 - 0.9185, towards 0.9300 before a significant lower high develops), but we are monitoring for signs that 0.9185 was the medium-term lower high under 0.9500 that we are looking for.

A break of range support and then 0.8296 would increase the chances that is the case.

On a broader perspective, hammer (at 0.8469 level) takes-off rallies above EMAs, bulls in major trend prolong range-bounded trend (refer monthly plotting), both leading & lagging oscillators bullish bias, uptrend likely to prolong on bullish EMA & MACD crossovers.

It is reckoned that the rebound from 0.8915 is a correction of the decline from 0.9054, ahead of a move back towards 0.8250 key long-term support which seems unlikely.

Trade tips: At spot reference: 0.9045 levels (while articulating), contemplating above technical rationale, one can execute boundary options strategy. Such exotic option with upper strikes at 0.9054 and lower strikes at 0.90 levels likely to fetch exponential yields than the spot moves.

Alternatively, we recommended shorts in EURGBP futures of near-month delivery, simultaneously, long hedges of September tenors for the upside risks in the major trend. Thereby, one can ensure directional positions amid macroeconomic turmoil.

Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics