EUR/GBP chart - Trading View

EUR/GBP Spot:

- The pair was trading 0.05% lower on the day at 0.8562 at around 08:25 GMT

- Session high was 0.8568 and low was 0.8554

- The pair closed 0.08% higher on Thursday's trade

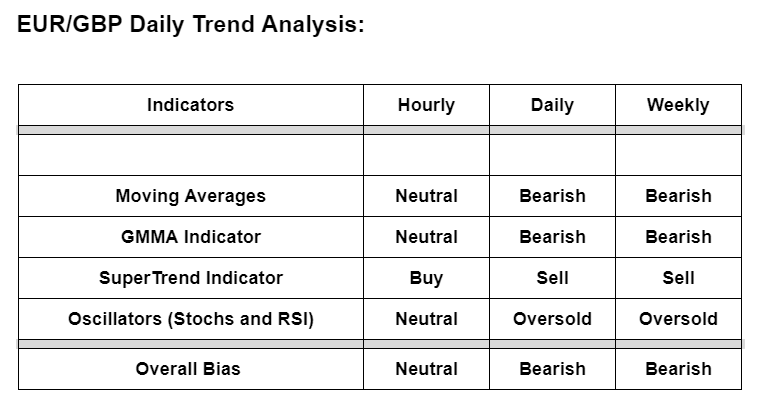

Technical Bias: Bearish

Technical Analysis:

Moving Averages: Price action is below major moving averages and moving averages are biased lower on the daily and weekly charts

GMMA Indicator: Analysis of GMMA indicator shows major and minor trend are bearish on daily and weekly charts

SuperTrend Indicator: SuperTrend indicator gives a Sell signal on daily and weekly charts. Any upside on the hourly charts could provide a good opportunity for entry

Oscillators (Stochs and RSI): Oversold conditions on daily and weekly charts warrants caution for possibility of pullbacks, however, no major signs of retrace are seen

Support levels - 0.8538 (Feb 24th low), 0.8488 (May 2019 low), 0.8415 (88.6% Fib)

Resistance levels - 0.8601 (200H MA), 0.8638 (21-EMA), 0.8643 (5W MA)

Summary: EUR/GBP trades with a major bearish bias. Oversold oscillators are a cause of concern. The pair is showing no major signs of retrace. However, price action is moving away from lower Bollinger band. Watch out for retrace above 200H MA for more upside. 21-EMA should cap any upside. Breakout at 21-EMA could change near-term dynamics.