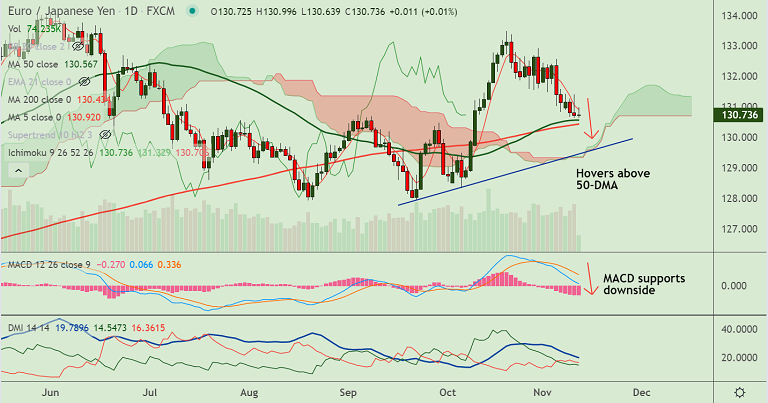

EUR/JPY chart - Courtesy Trading View

Technical Analysis: Bias Bearish

- EUR/JPY extends range trade above 50-DMA support

- Long upper wicks on the daily candles suggests selling pressure at highs

- 5-DMA caps upside and is biased lower

- Momentum is bearish, Stochs and RSI are sharply lower

- MACD supports weakness, GMMA indicators shows near-term moving averages are biased lower

Support levels - 130.56 (50-DMA), 130.43 (200-DMA), 130.29 (38.2% Fib)

Resistance levels - 130.91 (5-DMA), 131.02 (50% Fib), 131.35 (21-EMA)

Summary: EUR/JPY trades with a bearish bias. Strong support seen till 130.30. Breach below will drag the pair lower. Bounce off 200-DMA negates any further bearishness.