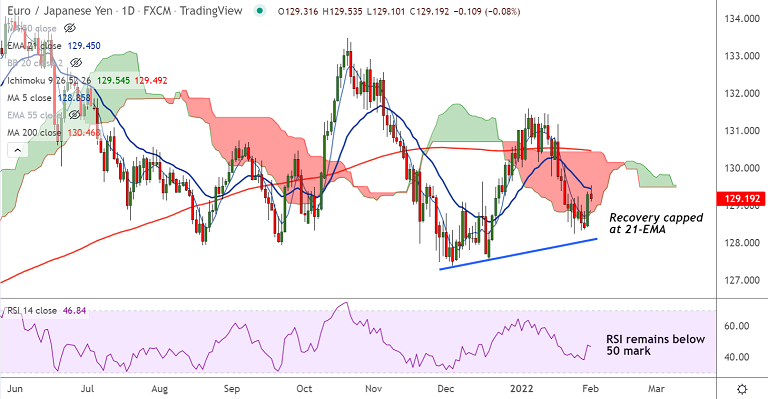

Chart - Courtesy Trading View

EUR/JPY was trading 0.12% lower on the day at 129.15 at around 10:20 GMT, outlook remains bearish.

Recovery attempts in the pair have been capped at 21-EMA, break above required for upside continuation.

On the data front, German and EMU final Manufacturing PMIs for January released earlier today came in a tad softer than the preliminary readings at 59.8 and 58.7, respectively.

In Germany, labour market figures were encouraging with the jobless rate retreating to 5.1% in January, with 2.345M persons unemployed, and the Unemployment Change shrinking by 48K people.

Also, German Retail Sales contracted 5.5% MoM in December and came in flat vs. December 2020.

Further, the European Central Bank (ECB) is likely to remain dovish, which will remain a drag on the single currency.

EUR/JPY finds series of stiff resistance upto 129.86. Break above will see gains till 200-DMA at 130.46. Bullish continuation only above 200-DMA.