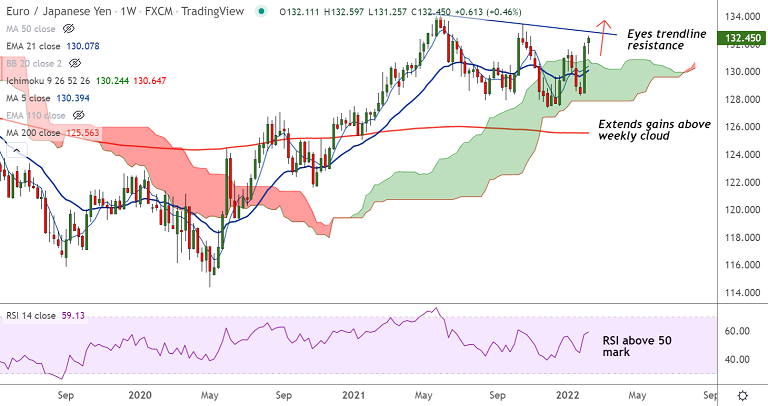

Chart - Courtesy Trading View

EUR/JPY was trading 0.39% higher on the day at 132.45 at around 10:30 GMT.

The pair is trading with a bullish bias and is extending break above weekly cloud.

GMMA indicator shows major and minor trend are bullish on the daily charts.

Volatility is high and rising as evidenced by wide spread Bollinger bands. Momentum is with the bulls.

MACD confirms bullish crossover on signal line and ADX supports gains with +ve DMI dominance.

Support levels - 132, 131.96 (5-DMA), 131, 130.74 (200H MA)

Resistance levels - 132.69 (Upper BB), 132.95 (Trendline), 133

Summary: EUR/JPY trades with a bullish bias. The pair is on track to test trendline resistance at 132.95. Breakout above will fuel further gains.