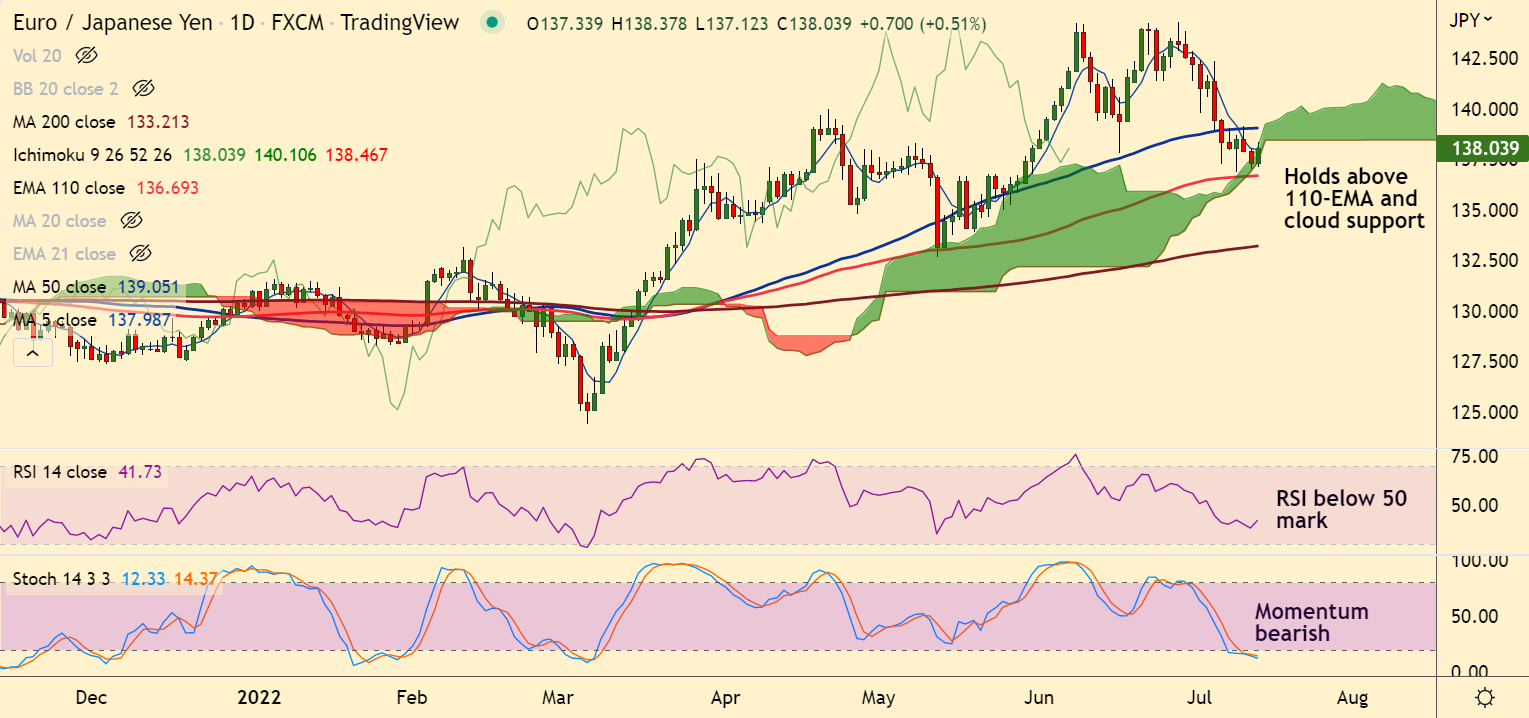

Chart - Courtesy Trading View

EUR/JPY was trading 0.30% higher on the day at 137.82 at around 12:45 GMT.

The pair has slipped lower from session highs at 138.36 and is trading below 5-DMA.

Upbeat Eurozone industrial figures, supported the single currency and further aided in upside in the pair.

Official data published by Eurostat showed on Wednesday that Eurozone’s Industrial Production increased more than expected in May.

Industrial Output arrived at 0.8% MoM vs. a 0.3% rise expected and 0.5% last. On an annualized basis, the Industrial Output rose by 1.6% in May versus a 0.3% growth expected and April’s -2.5%.

EUR/JPY has paused downside at 110-EMA and daily cloud support. Break below will plummet prices.

Momentum is bearish and volatility is high and rising. GMMA indicator shows minor trend is bearish.

Support levels - 136.69 (110-EMA), 136

Resistance levels - 138.84 (55-EMA), 139.04 (200H MA)

Summary: EUR/JPY capped between 55 and 110 EMAs. Major trend remains neutral and breakout will provide a clear directional bias.