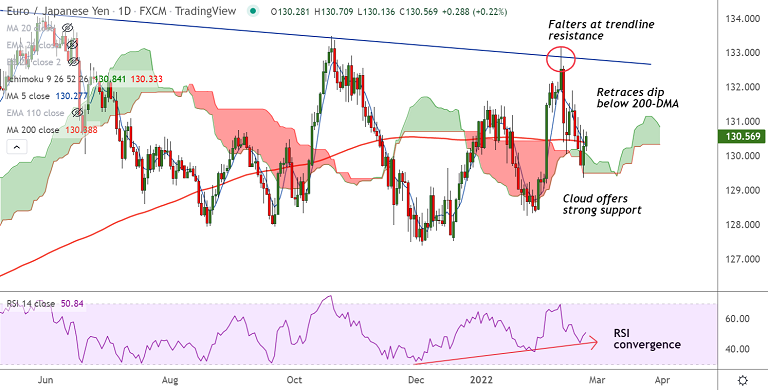

Chart - Courtesy Trading View

Technical Analysis: Bias Neutral

- EUR/JPY was trading 0.17% higher on the day at 130.50 at around 13:30 GMT

- The pair has retraced above 200-DMA raising scope for further upside

- Price action is making higher lows and RSI nicely converges with price action

- MACD and ADX still do not support upside, price action below 200H MA

- GMMA indicator shows neutral bias on minor and major trend

Support levels - 130.38 (200-DMA), 130.21 (55-EMA), 130.08 (110-EMA)

Resistance levels - 130.78 (200H MA), 131, 131.90 (Feb 16 high)

Summary: EUR/JPY hovers around 200-DMA, decisive close above will fuel further gains.