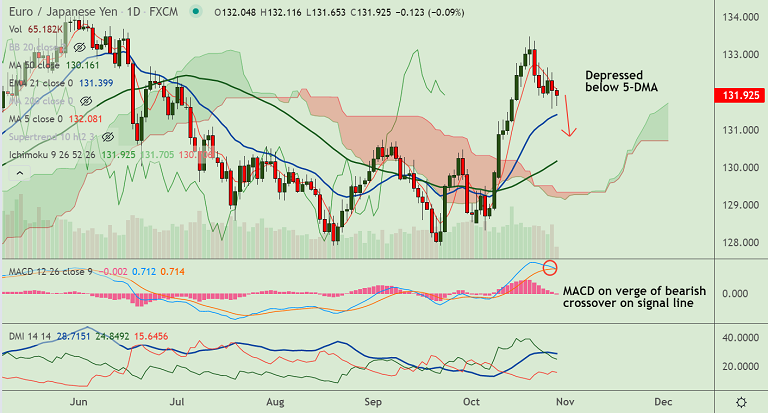

EUR/JPY chart - Trading View

Spot Analysis:

EUR/JPY was trading 0.20% lower on the day at 131.78 at around 10:10 GMT.

Previous Week's High/ Low: 133.48/ 131.91

Previous Session's High/ Low: 132.52/ 131.57

Fundamental Overview:

The European Central Bank (ECB) is scheduled to announce its monetary policy decision at 11:45 GMT, followed by the press conference at 12:30 GMT.

The central bank is expected to keep policy unchanged and wait for new economic projections at the December meeting before making any announcement.

Focus will be on ECB President Christine Lagarde's remarks at the post-meeting press conference for cues about a potential withdrawal of monetary accommodation.

On the other side, Bank of Japan (BOJ) kept monetary policy settings steady earlier on Thursday, maintained cash rate at -0.1% and its 10-year government bond yield target around 0%.

The central bank also cut its consumer inflation forecast for the year ending in March 2022 to 0% from 0.6%.

BoJ's decision reinforced market bets that the central bank will lag other central banks in dialling back crisis-mode policies.

Technical Analysis:

- EUR/JPY grinds lower along downward sloping 5-DMA

- Price action has slipped below 200H MA

- GMMA shows major and minor trend are bearish on the intraday charts

- Chikou span is biased lower

- MACD is on verge of bearish crossover on signal line

Major Support and Resistance Levels:

Support - 131.38 (21-EMA), Resistance - 132.51 (200H MA)

Summary: EUR/JPY poised for further downside. Dip till 21-EMA at 131.38 likely. Breach at 21-EMA will see further downside.