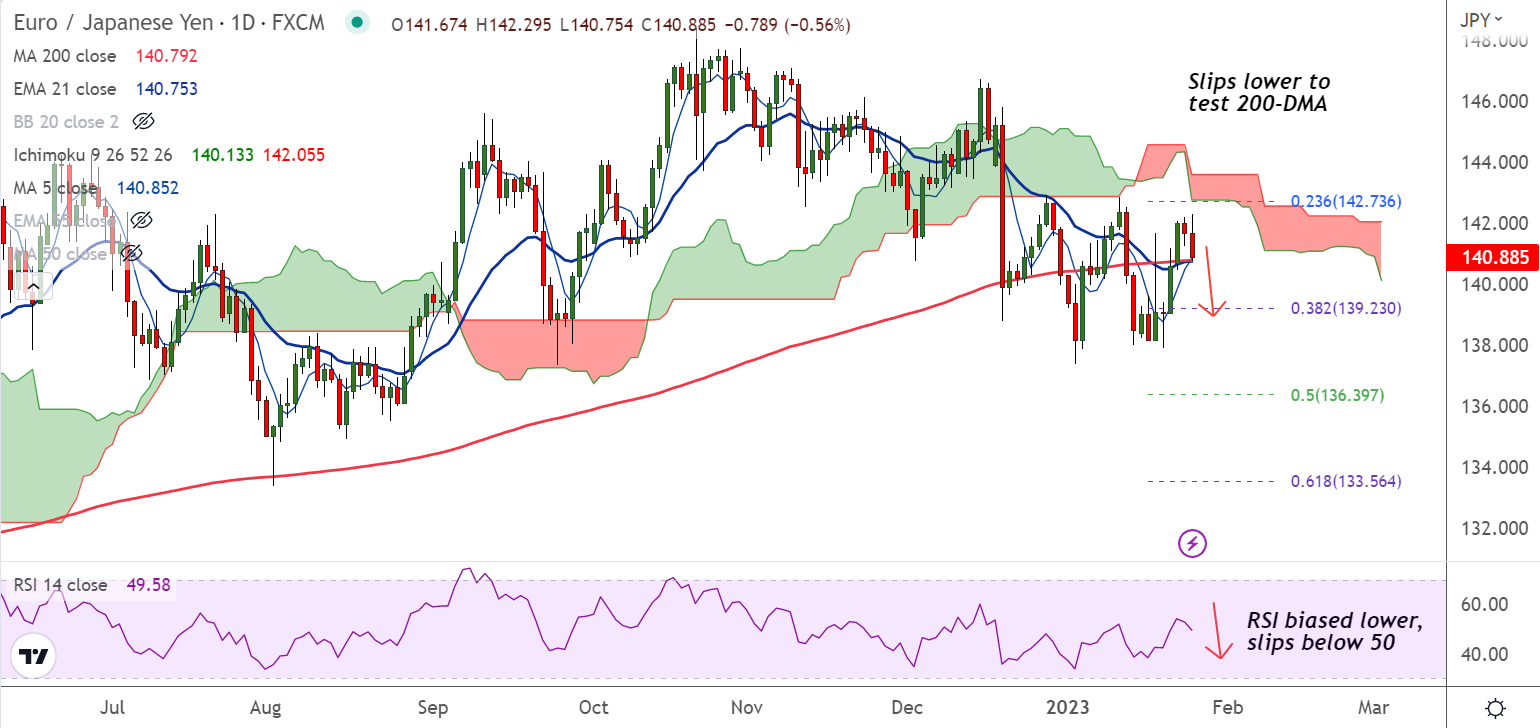

Chart - Courtesy Trading View

EUR/JPY was trading 0.61% lower on the day at 140.82 at around 12:40 GMT, tests 200-DMA support at 140.79.

Mixed data from the German IFO survey released earlier today and reviving safe-haven demand for the yen amid risk-off mood, dragged the pair lower.

Data released earlier today showed the headline German IFO Business Climate Index edged higher to 90.2 in January versus the previous reading of 88.6 and inline with forecast of 90.2.

Meanwhile, the Current Economic Assessment fell to 94.1 points in the reported month as against December's 94.4 and below expectations at 95.0.

The IFO Expectations Index rose to 86.4 in January from the previous month’s 83.2 and above the estimates of 85.0.

Further, despite a dovish Bank of Japan (BoJ) last week, markets expect that high inflation may invite a more hawkish stance from the central bank later this year.

Apart from this, a fresh wave of the global risk-aversion trade benefits the JPY's relative safe-haven status, adding downside pressure on the pair.

Support levels - 140.79 (200-DMA), 140.32 (20-DMA)

Resistance levels - 141.70 (110-EMA), 142.91 (Upper BB)

Summary: EUR/JPY pivotal at 200-DMA support. Watch out for break below for more weakness. Dip till 38.2% Fib at 139.23 likely.