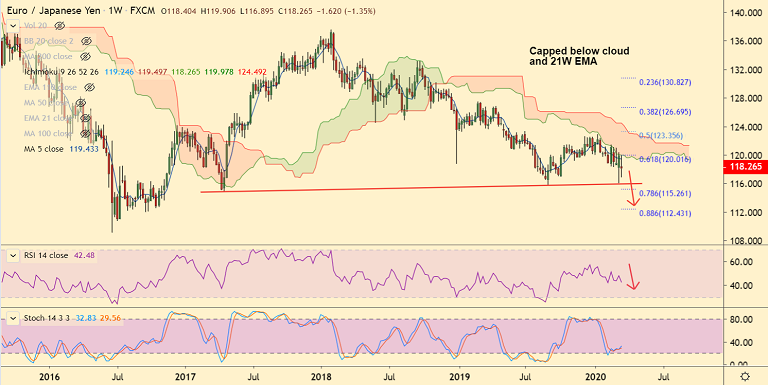

EUR/JPY chart - Trading View

EUR/JPY is extending range trade below 21-EMA, near-term outlook remains bearish.

The pair was trading 0.23% lower on the day at 118.07 at 10:38 GMT, after closing 0.33% higher in the previous session.

Euro dampened after the ECB announced a €750 billion QE programme late on Wednesday, expected to run at least until year-end.

Poor data which showed preliminary German IFO Business Climate dropped to 87.7 for the month of March, the lowest level since August 2009 added to the downside pressure.

Also, data released earlier today showed Eurozone Current Account surplus widened to €34.7 billion during January.

Price action has failed to break above 200-DMA. Major and minor trend for the pair are bearish.

Weekly cloud and 21W EMA offer stiff resistance on the upside. Momentum is bearish and RSI is below 50.

Resumption of downside likely. Next bear target lies at 116 (trendline) ahead of 78.6% Fib at 115.26.

Support levels - 116 (trendline), 115.26 (78.6% Fib)

Resistance levels - 118.87 (21-EMA), 120.05 (200-DMA)

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge